Something for your Espresso: Might need a Bailey in the Espresso this morning..

Good morning from Europe,

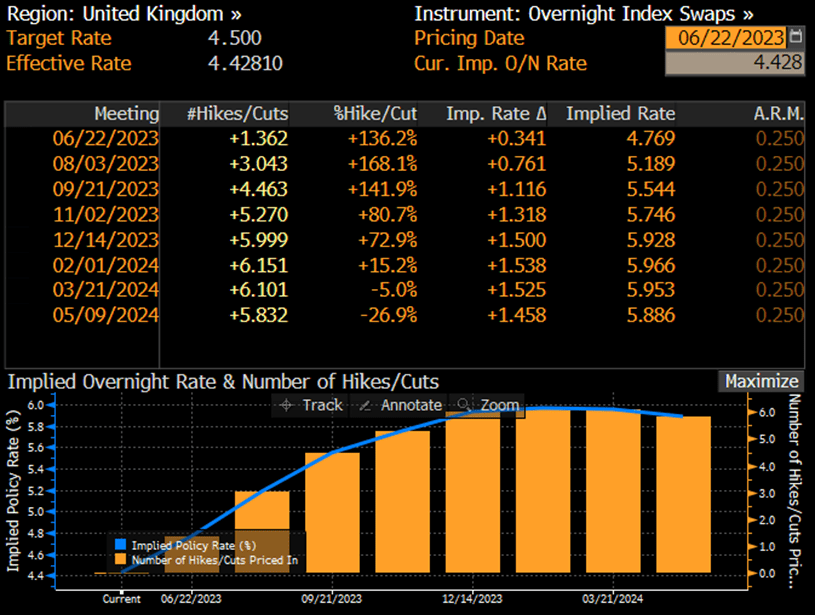

Get the popcorns ready for the Bank of England meeting today, which will be an entertaining watch. Markets have started chasing the 50bp rate hike in recent trading sessions and the Bank of England is damned if they do and damned if they don’t.

The price action in GBP markets kind of resembles the November-2022 mayhem in recent days with rates on a rapid rise while the GBP trades on the backfoot. A 50bp hike would signal panic and a 25bp would look weak.

Outside of the initial spike in GBP on the back of a 50bp hike, I tend to think that the path of least resistance is towards further weakening of the Sterling no matter what the BoE decides today.

The Bank of England has been on a dovish rate hiking path for a while, and we expect them to opt for a 25bp hike.

Chart 1: GBP forward pricing

The Bank of England is caught between a rock and a hard place, and it may be prudent to pour a bit of Bailey in the Espresso for the committee this morning. A 50 bp hike would signal panic, while delivering 25 bp risks jeopardizing the GBP.

0 Comments