Something for your Espresso: Lagarde’s tone rhyming with easier financial conditions

The ECB meeting was not full of surprises, but the updated staff projections were dovish in nature, and it allowed Lagarde to move the needle towards discussing rate cuts actively.

Lagarde kept saying that “we will know a little more in April but we will know A LOT more in June”, which is a strong hint that they will use the June meeting to cut interest rates if things develop according to plan.

The updated assumptions project inflation to average 2.3% in 2024, 2.0% in 2025 and 1.9% in 2026, which is down from the following numbers projected in December (2.7% in 2024, 2.1% in 2025 and 1.9% in 2026.)

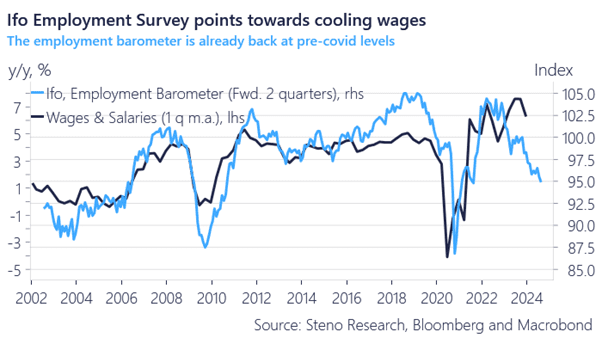

We see a scope for dovish wage surprises in particular relative to the still hawkish base-case from the ECB, while HICP inflation is now more in line with what seems reasonable to expect after two major dovish revisions in a row.

Chart 1: The ECB can still be dovishly surprised by wages

The ECB is now clear that they will discuss the rate cutting cycle at upcoming meetings. This will likely allow financial conditions to ease as we saw in the US from Q4 and onwards.

0 Comments