Something for your Espresso: Jpow paving the way for a dovish Lagarde

Morning from Europe.

After Jay Powell took the stage in congress yesterday, it is time for Christine Lagarde to host the ECB meeting. Powell mostly reiterated the rhetoric from the press conference at the latest FOMC meeting, which is designed to keep markets waiting for the first rate cut, watching the inflation data closely in the meantime.

Powell says that they need more inflation data before cutting, and markets have homed in on a little more than three cuts this year, which is almost in line with the current dot plot and projections from the Fed itself. The ECB obviously does not provide guidance on the rate path, which will leave markets guessing on the amount of cuts delivered in the modal outcome from the committee members.

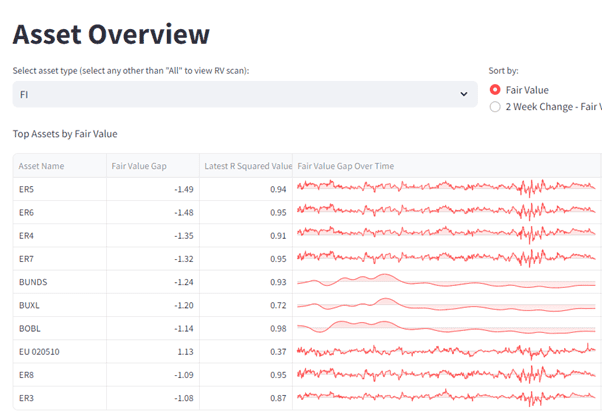

EUR rates trade out of sync with macro fundamentals heading into the ECB meeting according to our PCA tool, which is in contrast to the SOFR (USD) strip, which is basically trading in line with macro fundamentals.

From a model perspective, we like receiving EUR rates into this meeting but also due to the fundamentals surrounding the inflation forecasts.

Chart 1: PCA model highlights cheap EUR bonds and EURIBOR futs

Powell keeps a mostly unchanged easing bias intact despite signs of re-accelerating inflation. Lagarde will have the opportunity to make the public pivot by the ECB today.

0 Comments