Something for your Espresso: Is the stabilization in Asian FX sustainable?

There was suddenly a smell of pause in the air again with the bull/bear steepening of the USD curve in combo (short end rallying, while long end selling off), a weaker USD and a stabilization of Asian FX. We saw a large jump in Nasdaq/High beta risk due to the stabilization of Asian FX, which is exactly what we have alluded to.

If the PBoC manages to turn the tide on USDCNY, you better load UP on risk. We have patiently waited and will assess this very eagerly in the next few days.

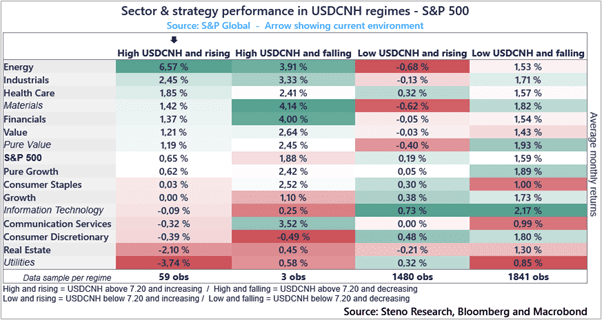

Energy is your (only) friend in equity space if the upwards pressure continues in USDCNY(CNH), while there is a big potential in Tech and Growth, if the trend turns in CNY due to a repricing of Chinese growth prospects.

Chart 1: USDCNY regimes and equity returns

Rhetorical intervention in JPY and CNY helped risk assets and high beta stocks perform yesterday, but is the stabilization sustainable or still fundamentally challenged? We lean towards the latter.

0 Comments