Something for your Espresso: Is the duration scare back?

Morning from Europe.

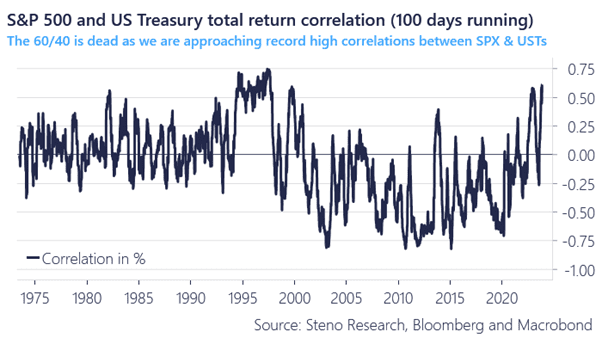

A very large tail in the 30yr US Treasury auction ignited another sell-off in the secondary market and the curve steepened materially. The decade-high correlations between equities and bonds continue and risk appetite has accordingly suffered again.

Central banks need to get inflation sustainably back below 3% everywhere to flip the correlation again and if they pause too early (wink, wink Fed), the positive equity to bond correlation may continue for another while.

Chart 1: Is the 60/40 dead until central banks get inflation reigned in?

The duration scare is back after a weak 30yr auction. We are yet to enter a home-run environment for USD durationistas, but a flatter curve may be on the cards until the December FOMC-meeting.

0 Comments