Something for your Espresso: Is China rebounding or not?

Morning from Europe.

The RBNZ remained steady at 5.50% OCR rates as expected, but the rhetoric was full of pessimistic vibes around the global economy.

From the RBNZ statement:

“The Committee remains confident that the current level of the OCR is restricting demand. However, a sustained decline in capacity pressures in the New Zealand economy is required to ensure that headline inflation returns to the 1 to 3 percent target. The OCR needs to remain at a restrictive level for a sustained period of time to ensure this occurs. “

Loads of rhetoric in the statement still refers to a global slowdown including clear hints of a continued structural malaise in China. Despite the attempts to re-affirm the “firm for longer” on the OCR, the vibes are pretty dovish from the RBNZ and the NZD sells off while 2yr OIS swaps are down almost 20 bps.

This is another hint that RBNZ and RBA remain stuck a bit behind the curve in G10 space, why we find AUD and NZD duration to be among the most attractive positions in G10 FI space.

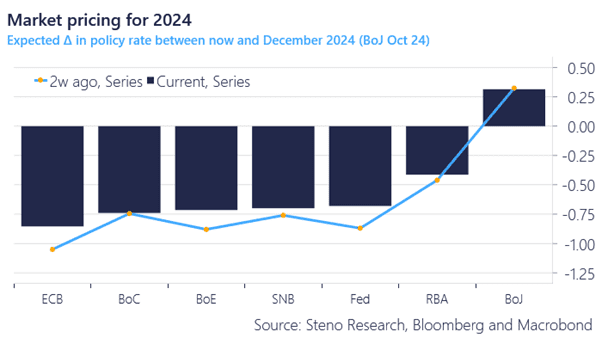

Chart 1: G10 pricing

Is China actually rebounding here? Oceanian central banks remain skeptical, while certain cyclical markets are starting to discount a slightly less abysmal Chinese scenario.

0 Comments