Something for your Espresso: How to deal with the new Fed feed-back loop?

Morning from Europe.

The Powell press conference had dovish vibes tattooed all over it as markets perceived the hesitancy towards forward guidance despite strong data on Growth and Inflation as a sign of weakness or capitulation.

It was on the surface an ambiguous rhetoric from Powell as we balanced between two contradicting viewpoints:

1) Full acknowledgement of vanilla data (GDP, Non-farm, CPI) suggesting that they should remain tight(er) for longer, also backing the dot plot from September

2) A few caveats introduced with higher long-term bond yields / term-premias being used as an “excuse” for tighter conditions than in June/September

The latter is a dangerous feedback loop. If Powell accepts that market conditions dictate the path for the Fed Funds rate, the dovish reaction seen in market rates and equities yesterday implicitly leads to a more hawkish reaction function.

If 10yr bond yields are down 25-50 bps and equities are 5-10% higher come December, can they then refrain from hiking? I doubt it.

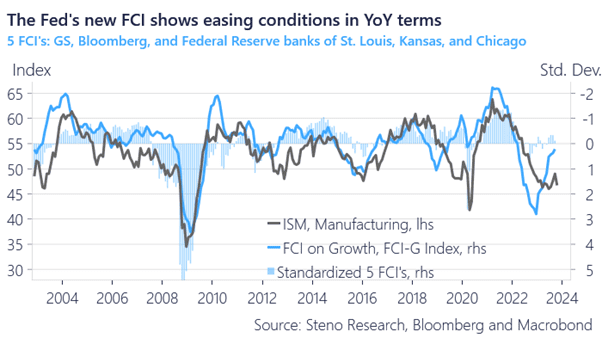

Chart 1: Financial conditions are not particularly tough from a momentum perspective

Powell sounded dovish yesterday, but also opened the door for a potential unconstructive feedback loop by allowing market conditions to dictate the policy rates. If market rates drop and equities perform, the FOMC will have to act in December.

0 Comments