Something for your Espresso: Hawks on parade

Good morning from Europe

Hawks are on parade!

Bullard and Kaskhari from the Fed have both been out parading yesterday. Bullard calling for additional 2x 25bps, while Kashkari said that he opposes and explicit pause in June. Bullard was generally a very decent leading indicator of the FOMC consensus through 2021/2022, but we suspect that it is not the case this time around. Mary Daly said earlier that the SLOOS survey should remove at least 2x 25 bp from the Fed Funds base case and after all she is closer to the median vote/voice within the FOMC.

2yr USTs have broken technically to the downside, but we like entry levels here as the upside in front end yields has been based on flawed/questionable data (Canadian CPI and Initial Claims). The June hike is not on the table for the median voter within the FOMC unless something dramatic happens. Even Kashkari seems open to a consensus skip in June, why the Fed is likely to conclude on no changes but accordingly also no promises of a prolonged pause.

Don’t bet on hikes, but rather on a prolonged pause, if you buy the high(er) for longer narrative. Receiving July/Sep vs. paying Dec in SOFRs make sense.

Learn more about what it means for the USD and our trading portfolio with a free trial below.

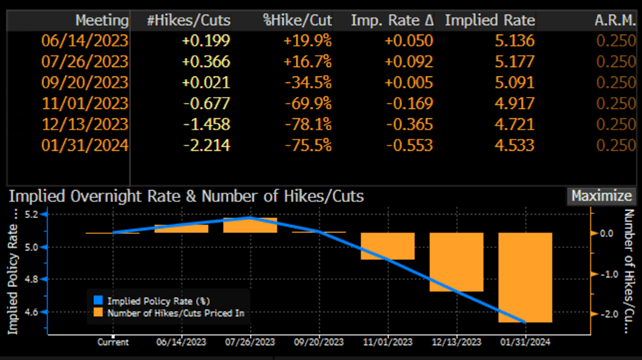

Chart 1: Fed pricing

The FOMC hawks have been parading over the past 24 hours, but the base case remains solid for a pause in June. Don’t count on further hikes, but maybe on a “prolonged” pause. Receive July vs paying Dec in SOFRs?

0 Comments