Something for your Espresso: Germany is in a recession

Good Morning from Europe

Germany is now officially in a “technical recession” as the revised first quarter GDP from Germany printed at -0.3% QoQ. Industrial production suffered massively towards the end of Q1, while the unemployment rate is up >0.5% since the bottom in 2022. All in all, it is probably fair to say that Germany already is in some sort of recession – not a massive or deep one – but a recession.

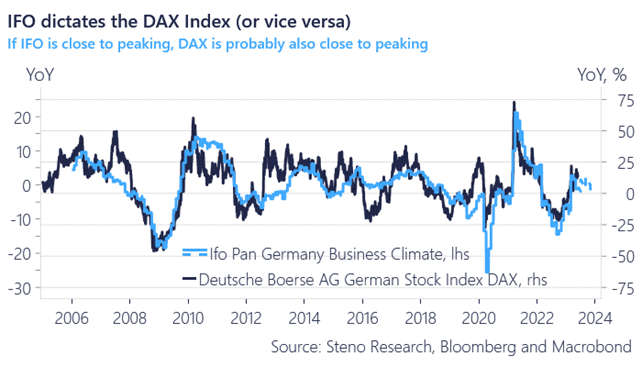

The IFO index has started to roll-over in Germany again and we find a very neat correlation between IFO and DAX (and the EUR), meaning that EUR and DAX bulls need to find a good explanation of why the IFO index should rebound further from here.

The consensus EUR optimism is already overstretched. The big issue for policy makers in Europe is that the recessionary growth vibes are yet to kill inflation.

Chart 1: IFO rolls over, so does DAX

IFO seems to have peaked, and Germany likely already is in some sort of recession. Will the ECB care? And will EUR + DAX bulls care? FOMC Minutes reveal increasing divergence of views within the board.

0 Comments