Something for your Espresso: Duration is hard to swallow

Morning from Europe

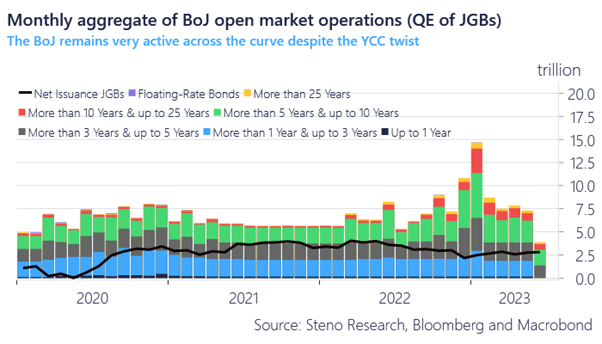

The Bank of Japan has been active in JGB markets again today and the weakness in the JPY continues. We revealed how the BoJ still buys more than net issuance on an average basis despite having scaled down purchase markedly since early Q1. This leads to a continued crowding out of private investors and a debasement of the JPY relative to peers.

We stick to our view that the JGB market could slowly but surely steepen further, while the JPY will be hard to keep below 150 against the USD, if the BoJ continues to outprint peers at this pace.

Chart 1: The BoJ keeps adding to market shares

The market struggles with duration issuance as the positioning is already loaded with bonds, while the BoJ keeps weakening the JPY (on purpose) as they continue to crowd out investments.

0 Comments