Something for your Espresso: Davos pushing back!

Morning from Europe!

Davos week has seen the “hawks on parade” in central bank space with for example Lagarde and Nagel trying to push back on rate cut expectations. Dovish inflation surprises (relative to the central bank projections) are probably needed to validate the current market pricing, but we remain firm that such surprises are on the cards in especially Europe.

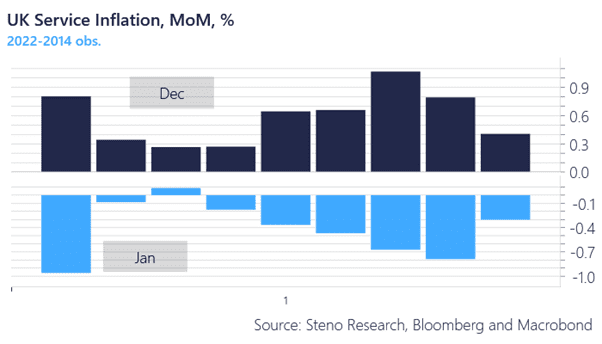

Especially the GBP rates market re-accelerated yesterday on the back of an oddly firm Services CPI print. The good news is that it will reverse with the release of the January inflation numbers in a month from now. The seasonality in UK Services is extremely auto-regressive times -1. When the December UK Services print is hot, the January Services print is cold. Almost a perfect match.

There is hence no reason to be scared of the print in the UK. We fade the move in GBP front-end rates and the GBP.

Chart 1: What goes up, must come down? UK service CPI version

Central bankers across the G10 space currently push back against market pricing. The market will likely eventually force their hands but chubby markets will be seen until.

0 Comments