Something for your Espresso: Bye bye USD?

Morning from Europe!

The USD is trading weak, especially against low-yielding peers such as JPY, CHF and Gold. Typically, we would see this as a sign that Geopolitics start to matter again, but given the lack of “risk premia” additions in other asset classes, this is probably rather to be seen as a classic disinflation/deflation move in FX space.

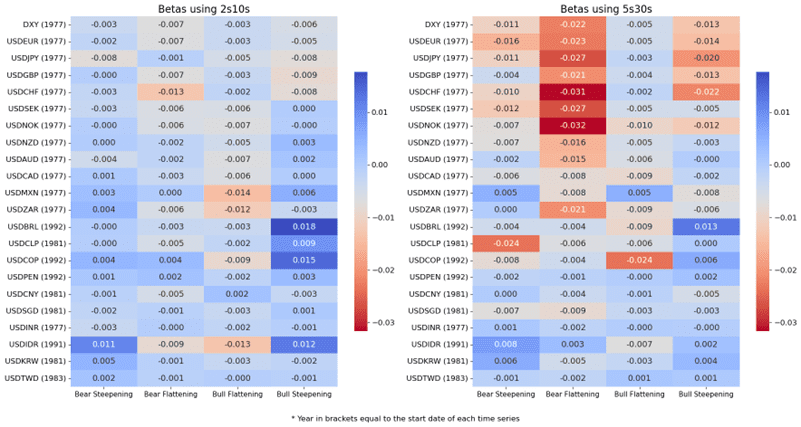

The moves in FX space are consistent with a bull-steepening scenario for the yield curve into 2024. Should the bull curve steepening continue, USDJPY typically drops markedly alongside USDCHF. Both EUR and GBP also have positive betas versus the USD in a bull-steepening scenario.

The market consensus is (or at least was) that the Bank of Japan is likely to hike interest rates around the end of the fiscal year in April 2024, probably in conjunction with the second update to their “Outlook for Economic Activity and Prices” on Apr. 26.

Ueda recently showed early signs of hesitancy by referring to the global impact of the new FOMC dot plot showing three cuts in 2024, and if the Fed pricing turns even more dovish ahead of the April 2024 meeting at the Bank of Japan, the BoJ may end up with no choice but to ease alongside the rest of G10 central banks, should the JPY prove to be too strong.

Given recent trends, this scenario is growing in likelihood by the minute.

Chart 1: FX Betas to the yield curve

The USD is trading weak versus especially low-yielding peers, which is consistent with a bull-steepening of the yield curve. The question is if the SNB and the BoJ will have to change plans due to stronger FX developments.

0 Comments