Something for your Espresso: Big in China instead of Japan?

Strong sentiment in Chinese stocks paired with weak sentiment in Japanese stocks from the morning and the relative value in being long South Korea and/or China against Japan in equity space has been flagged by our PCA tool over the past week

The Japanese yield curve is likely going to flatten should the BoJ start lift-off of the front-end in March (as seems likely now), meaning that the Japanese investment case is now JPY FX and not Nikkei according to our fair value studies.

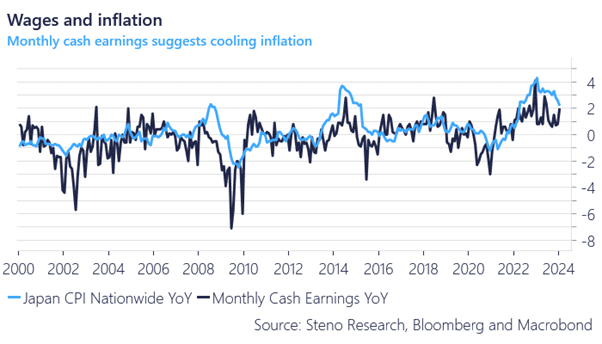

The monthly cash earnings rose to around 2% last week in Japan ahead of a BIG wage week with resumed negotiations at Toyota. We remain short CHF/JPY ahead of the BOJ meeting and the wage rounds.

Chart 1: Japanese wages around 2% for now

Sentiment in Japanese stocks has weakened ahead of a potential lift-off on front-end rates in March, while the JPY FX case looks compelling still. Meanwhile, Chinese sentiment is improving both directly and via proxies.

0 Comments