Crypto Moves #26 – What Goes Up Must Come Down

The crypto market has experienced a second-to-none year so far. Now, as summer begins, it may be a good time to unwind with a Gin & Tonic and enjoy the sunshine, given that the crypto market is unlikely to offer much excitement in the near future.

According to the latest issue of ‘Crypto Crisp‘ published on Monday, we have adopted a bearish outlook for the short-term prospects of the crypto market. Our reasoning centers almost exclusively on narratives.

In contrast to other markets where price movements usually dictate the narrative, the crypto market often sees this relationship reversed: narratives drive prices. Despite whether we accept it or not, market participants most often invest in crypto assets believing that others will be willing to purchase their holdings at higher prices soon, especially if compelling, yet unrealized narratives are circulating.

This year has already seen two significant narratives that have influenced the market: the approval of the U.S.-based Bitcoin spot ETFs on January 10, and the recent fourth Bitcoin halving. While the Bitcoin spot ETFs have directly increased buying pressure on Bitcoin, the primary impact of both events has been from traders betting that these developments could significantly boost Bitcoin’s price.

In the short term, these narratives no longer wield any influence. On the contrary, we anticipate a significant number of market participants will offload their Bitcoin holdings, which were acquired in hopes of robust price increases driven by these very narratives.

This group includes traditional investors who purchased some of the newly launched Bitcoin spot ETFs, expecting a surge in value from the highly anticipated Bitcoin halving. We predicted this outcome in our Crypto Moves #22 publication from a month ago. In that issue, we discussed our expectation that the upcoming Bitcoin halving would become a classic ‘buy the rumor, sell the news’ event. We argued that the “weak hands” – investors who entered the market expecting quick profits, including those in ETFs – would pull out once it became apparent that the halving would not have an immediate, positive impact on prices.

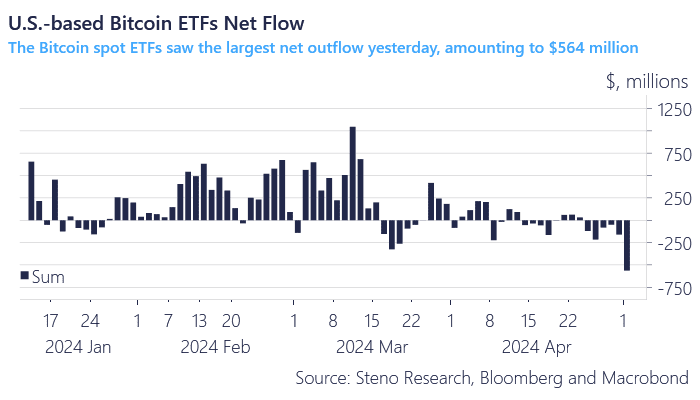

Indeed, this is now unfolding as predicted. Since the halving on April 20, the U.S.-based Bitcoin spot ETFs have seen a net outflow of $1.105 billion. Just yesterday, these ETFs recorded their largest single-day net outflow since their listing nearly four months ago, totaling $564 million.

Chart 1: U.S.-based Bitcoin ETFs Net Flow

One significant consequence of this outflow is the downward pressure it exerts on Bitcoin’s price due to spot selling. Equally impactful, if not more so, is the fact that the previously robust inflow served as a compelling narrative itself. With these inflows being highly visible to the public, they created a strong self-reinforcing cycle, encouraging many to purchase Bitcoin under the assumption that the ETF inflows would perpetuate indefinitely.

The crypto market experienced a remarkable rally from late last year up to now. However, all good things eventually come to an end. The market is facing a shortage of compelling short-term narratives, significant selling pressure, and unfavorable seasonal trends. While increased liquidity might provide some relief, it is unlikely to make a significant impact in the near term.

0 Comments