Crypto Moves #22 – The 2024 Bitcoin Halving Will Be A ‘Buy the Rumor, Sell the News’ Event

This exact edition of Crypto Moves is free. If you want to read future editions, either on our website or sent directly to your e-mail, then please sign up here. For a limited time until April 12, you get 20% off an annual Crypto or Premium plan by using the code ‘halving20’, so you get our independent crypto research for only $160 annually (excl. VAT & taxes).

We are swiftly approaching the fourth Bitcoin halving, which is expected to take place at block number 840,000. Currently, the network has reached a block height of approximately 837,700.

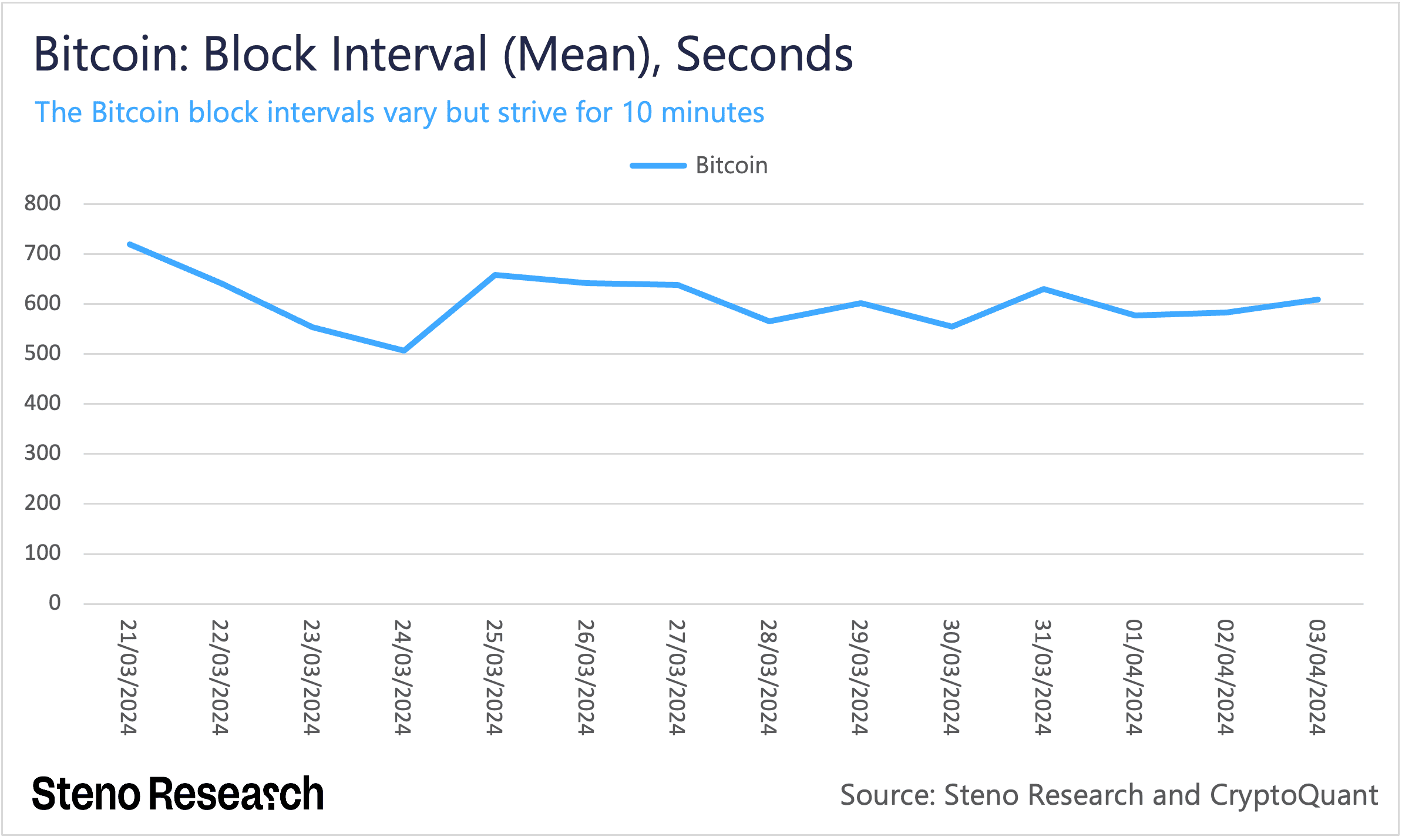

Bitcoin experiences a halving event every 210,000 blocks. The Bitcoin network aims for a block generation time of 10 minutes, meaning that halving events are scheduled to happen about every four years. According to this schedule, miners are set to propose a new block every 10 minutes. The miner who successfully submits a block is rewarded with a block reward. This reward includes a set number of newly minted Bitcoins for each block, in addition to the transaction fees from the transactions included in that block.

However, the actual block generation time can deviate from the intended 10 minutes due to changes in the network’s hashrate. The hashrate represents the total computational power being used for Bitcoin mining. It fluctuates until the mining difficulty is adjusted, which happens approximately every two weeks. This variability contrasts with the exact block times found in cryptocurrencies that use a Proof-of-Stake consensus mechanism, such as Ethereum, which processes blocks precisely every 12 seconds.

Over the last 14 days, the average block time has been 10 minutes and 9.7 seconds, based on the daily mean. With this timing in mind, we predict that the halving will occur slightly less than 16 days from now, which would be on April 20, around 4 PM GMT+1.

Chart 1: Bitcoin Block Interval (Mean)

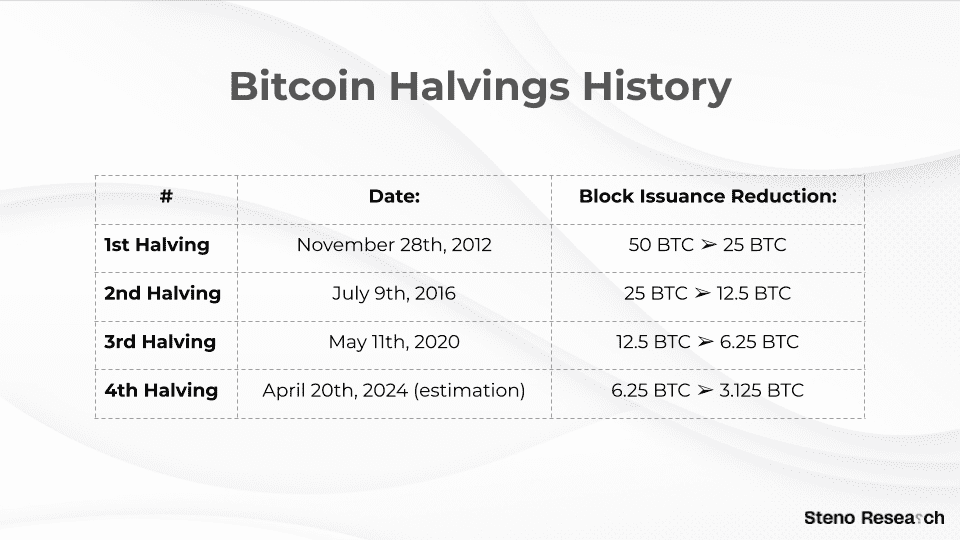

The upcoming fourth Bitcoin halving will reduce the miners’ reward for new Bitcoin issuance from the current 6.25 bitcoins to 3.125 bitcoins per block. Since Bitcoin’s genesis block in January 2009, the block reward issuance has decreased from 50 to then 3.125 bitcoins.

Chart 2: Bitcoin Halvings History

The smallest yet the biggest halving

One does not need a Ph.D. in physics to understand that the forthcoming fourth Bitcoin halving will result in the smallest reduction in new issuance, in terms of bitcoins, in Bitcoin’s history so far.

Although the reduction in the number of bitcoins awarded as a block reward is the smallest yet, when measured in dollars, the value of this issuance reduction is at its highest ever, simply due to the Bitcoin price being near its all-time high. For context, at the time of the third halving on May 11, 2020, the Bitcoin price was approximately $8,800. At present, it stands at around $66,800.

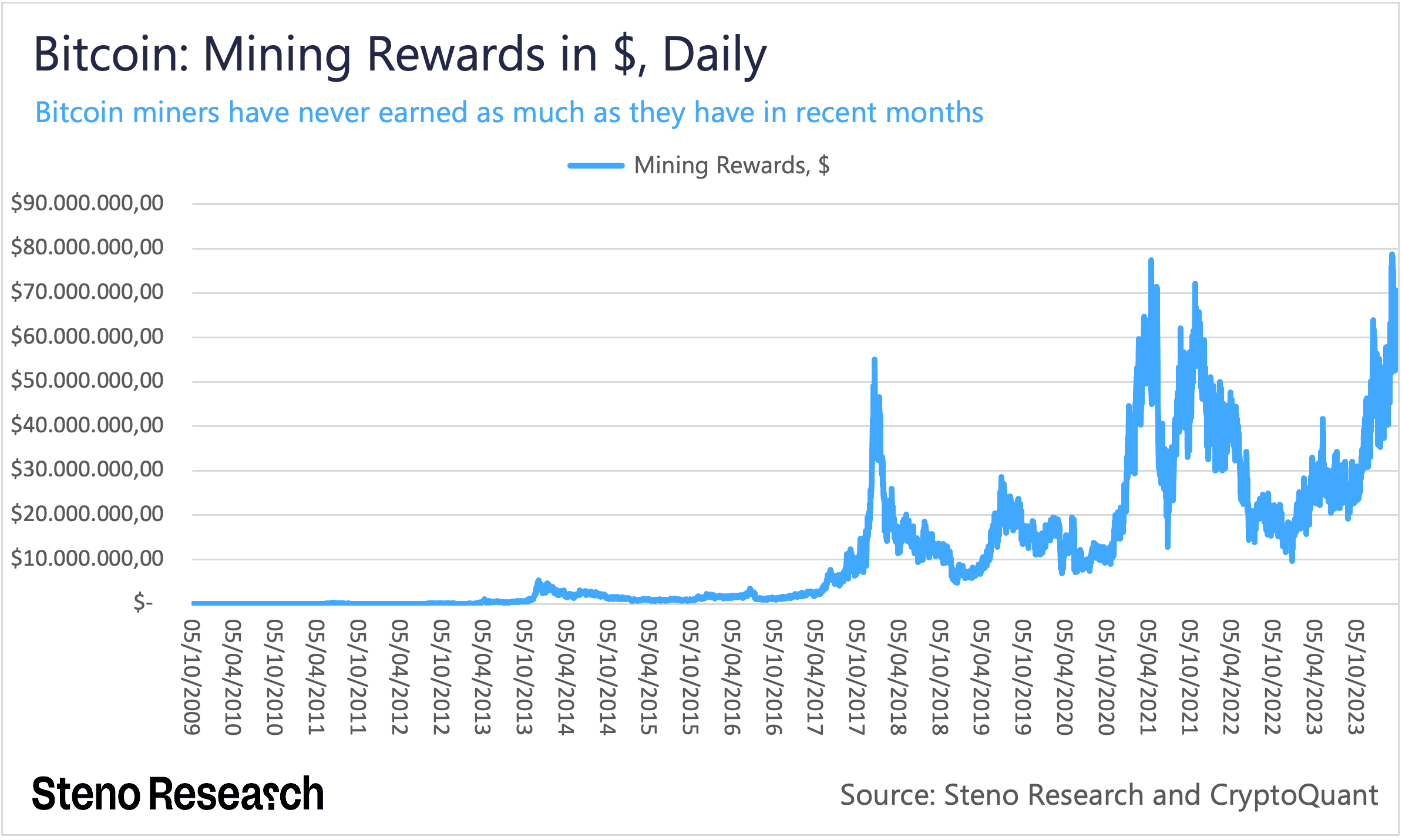

Chart 3: Daily Mining Rewards in USD

At the $8,800 price point in May 2020, the third halving resulted in a reduction of block issuance value equal to $55,000. With the current price at approximately $67,800, this reduction now translates to $211,875 worth of bitcoins, despite the nominal reduction being half of what it was during the previous Bitcoin halving. While it is true that there has been significant inflation since May 2020, approximately 25%, this inflation rate does not come close to matching the imminent reduction in Bitcoin issuance when measured in dollars.

We discussed the economics of Bitcoin mining in detail in Crypto Moves #2, highlighting that miners, over time, sell all their bitcoins to cover the substantial fiat-money costs associated with their mining operations. This makes Bitcoin miners the largest group of sellers in the market, consistently placing significant selling pressure on Bitcoin. Since our analysis in mid-November last year, the Bitcoin price has surged by over 80%, from $36,500 to the current $67,800.

The substantial increase in the USD value of miner rewards might lead some to speculate that miners have been selling fewer bitcoins, as they can now generate the same USD revenue with fewer bitcoins sold, potentially saving some for future needs, especially with the next halving on the horizon.

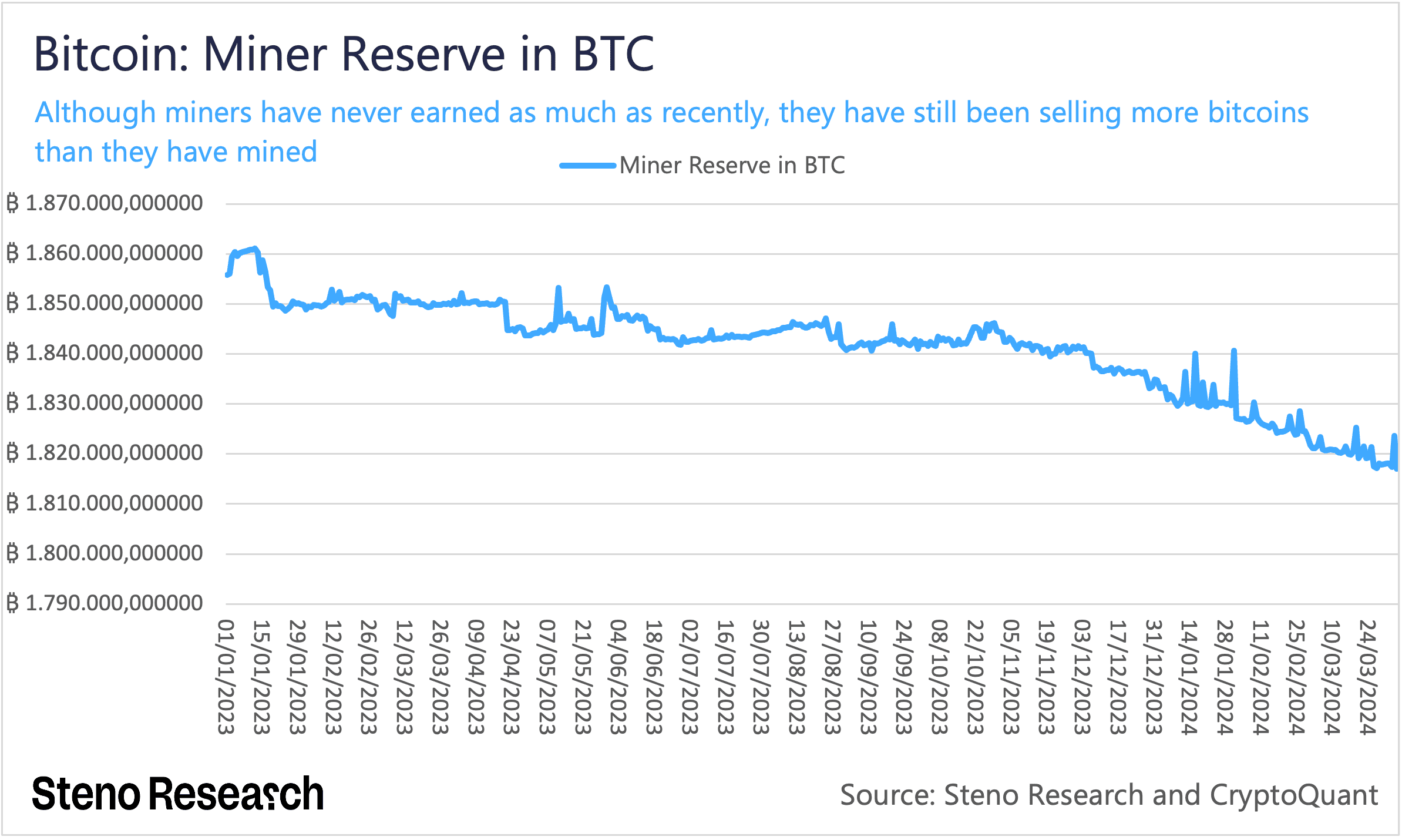

However, onchain data tells a different story. It is evident that miners have been selling more bitcoins than they have mined, particularly in recent months. This suggests that when the halving occurs, miners will not have a reserve to offset the reduction in mining rewards. Consequently, we anticipate a significant decrease in selling pressure from miners shortly after the halving takes place.

Chart 4: Miner Reserve in BTC

Given that Bitcoin’s price has remained exceptionally high for over a month, during which miners have not only sold off their entire mining rewards but also dipped into their reserves, it is clear that the market has adjusted to a new equilibrium, one that accommodates the all-time high selling activity by miners. When this selling pressure is reduced by half due to the halving, especially in a market that has already found its balance with such levels of selling, we strongly believe that the halving will propel the market upwards in the long-term but not necessarily in the short-term.

Down short-term, up long-term

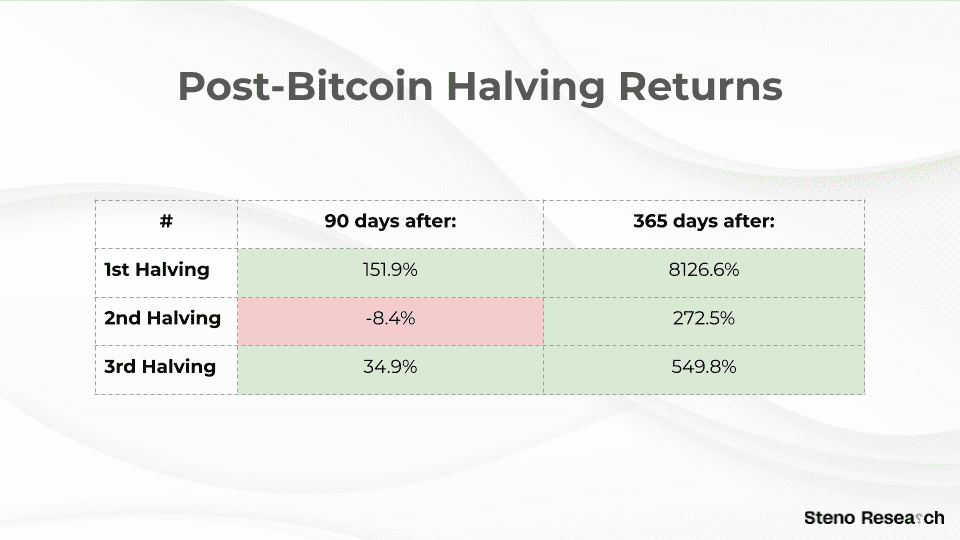

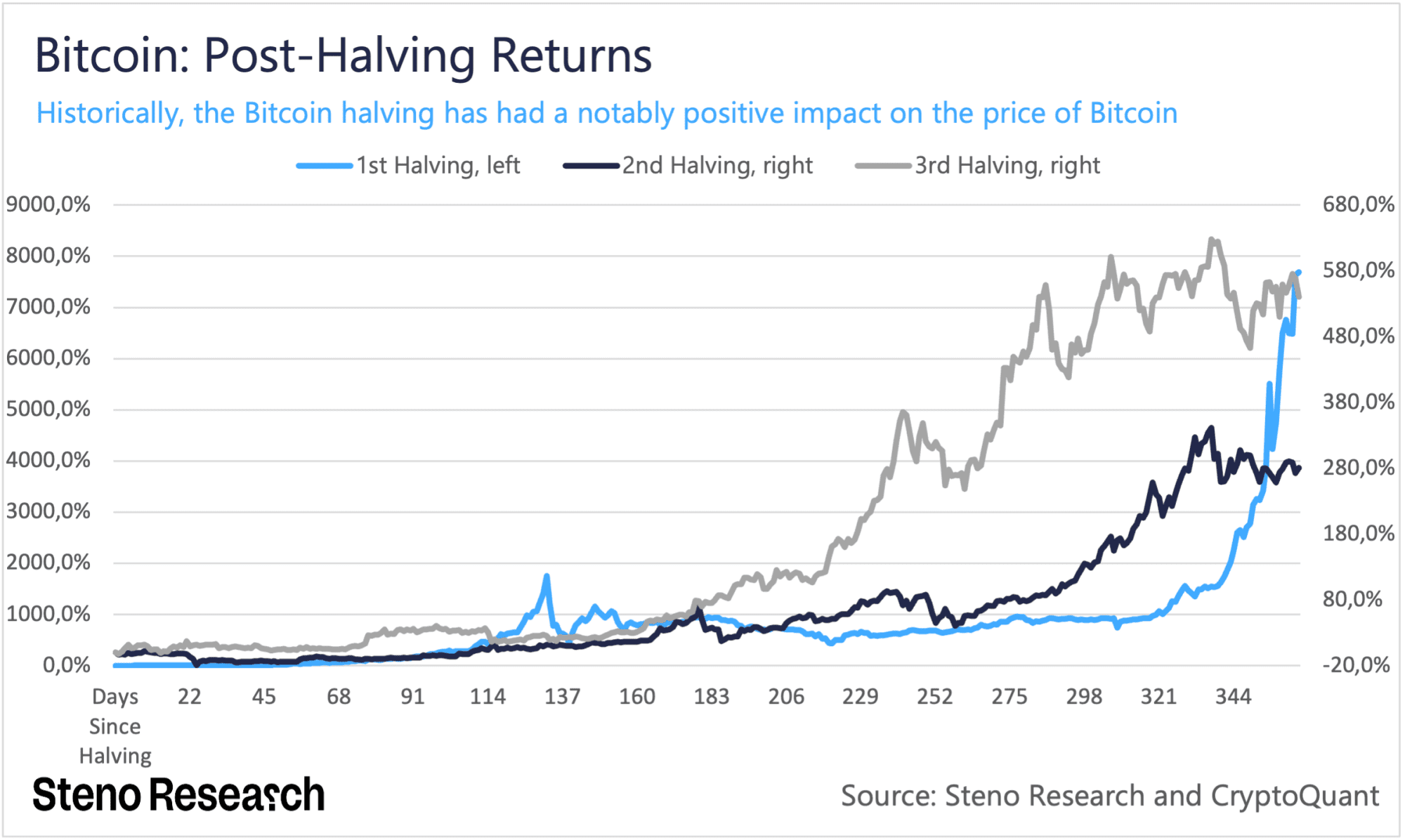

The history of Bitcoin’s three previous halvings reinforces our belief that the upcoming fourth halving will drive the Bitcoin price higher. According to price data, Bitcoin has experienced significant growth in the year following each halving. Notably, after the second halving in 2016, Bitcoin’s price soared by 272.5%. The year following the most recent 2020 halving saw an even more impressive surge of approximately 549.8%.

However, the first halving, which resulted in a price increase of over 8,000% in the subsequent year, is not directly comparable to the forthcoming fourth halving. During the time of the first halving, there were far fewer bitcoins in circulation, the market was highly illiquid, and Bitcoin had barely any adoption. As a result, we will exclude the first halving from our comparison due to these significant differences.

Chart 5: Post-Bitcoin Halving Returns, Simplified

Chart 6: Post-Bitcoin Halving Returns

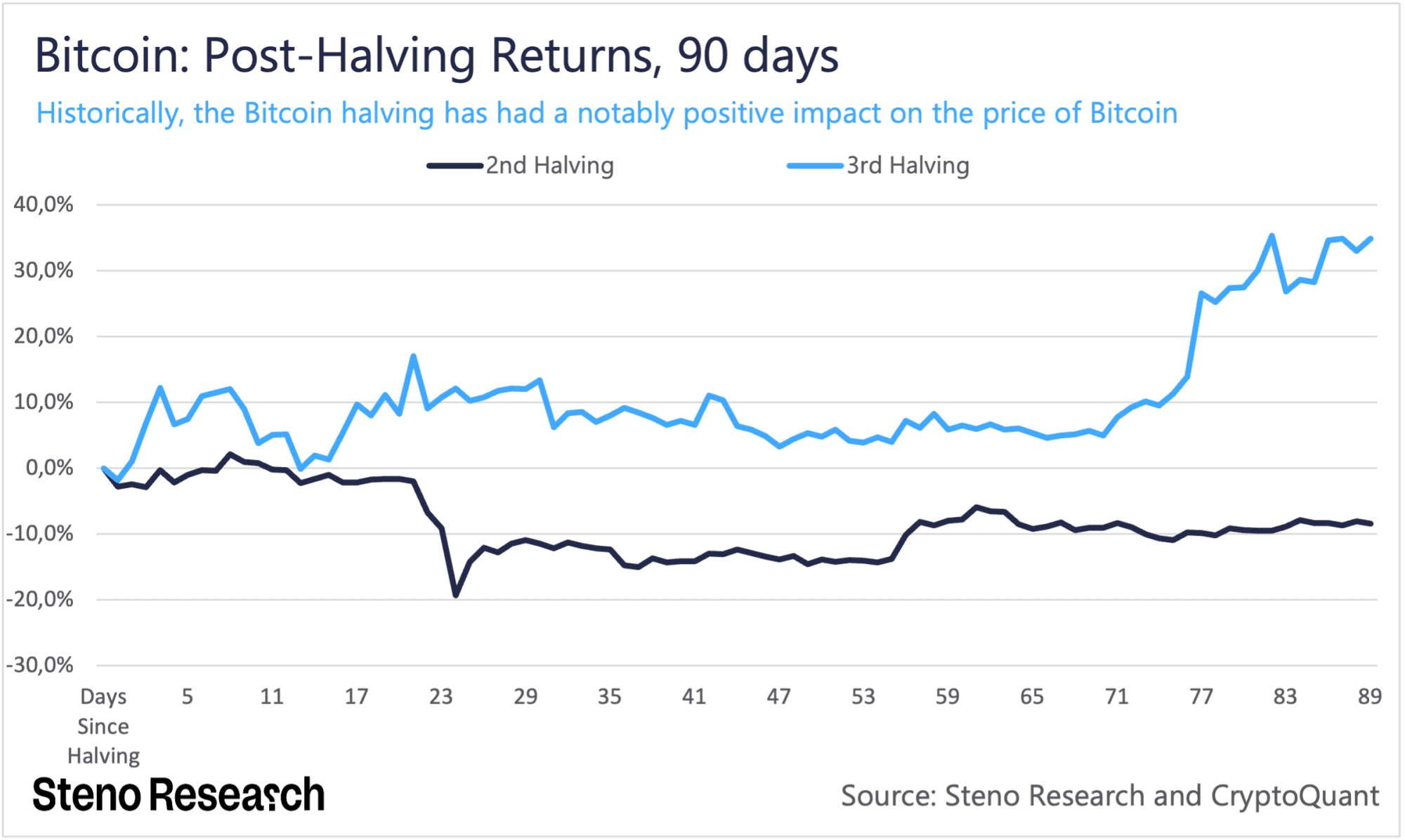

The historical patterns following Bitcoin’s halvings illustrate that while the Bitcoin price is much higher a year after each of the three halvings, the immediate impact on the price is not as pronounced. In other words, the supply shock induced by halvings does not translate into instant price appreciation. Instead, the price movements in the short term following a halving are generally more subdued. Taking the most recent halving as an example, Bitcoin experienced a 34.9% increase after the first 90 days, though for a significant portion of that period, the appreciation was under 10%.

The aftermath of the second halving in 2016 presents an even more stark contrast in the short term. For almost the entire 90 days following the halving, Bitcoin’s price remained below its pre-halving level. Specifically, on the 90th day post-halving, Bitcoin was priced 8.4% lower than before the halving. It was not until nearly four months had passed that Bitcoin’s price entered positive territory relative to its pre-halving level, highlighting the delayed effect halvings can have on market prices.

Chart 7: Post-Bitcoin Halving Returns, 90 days

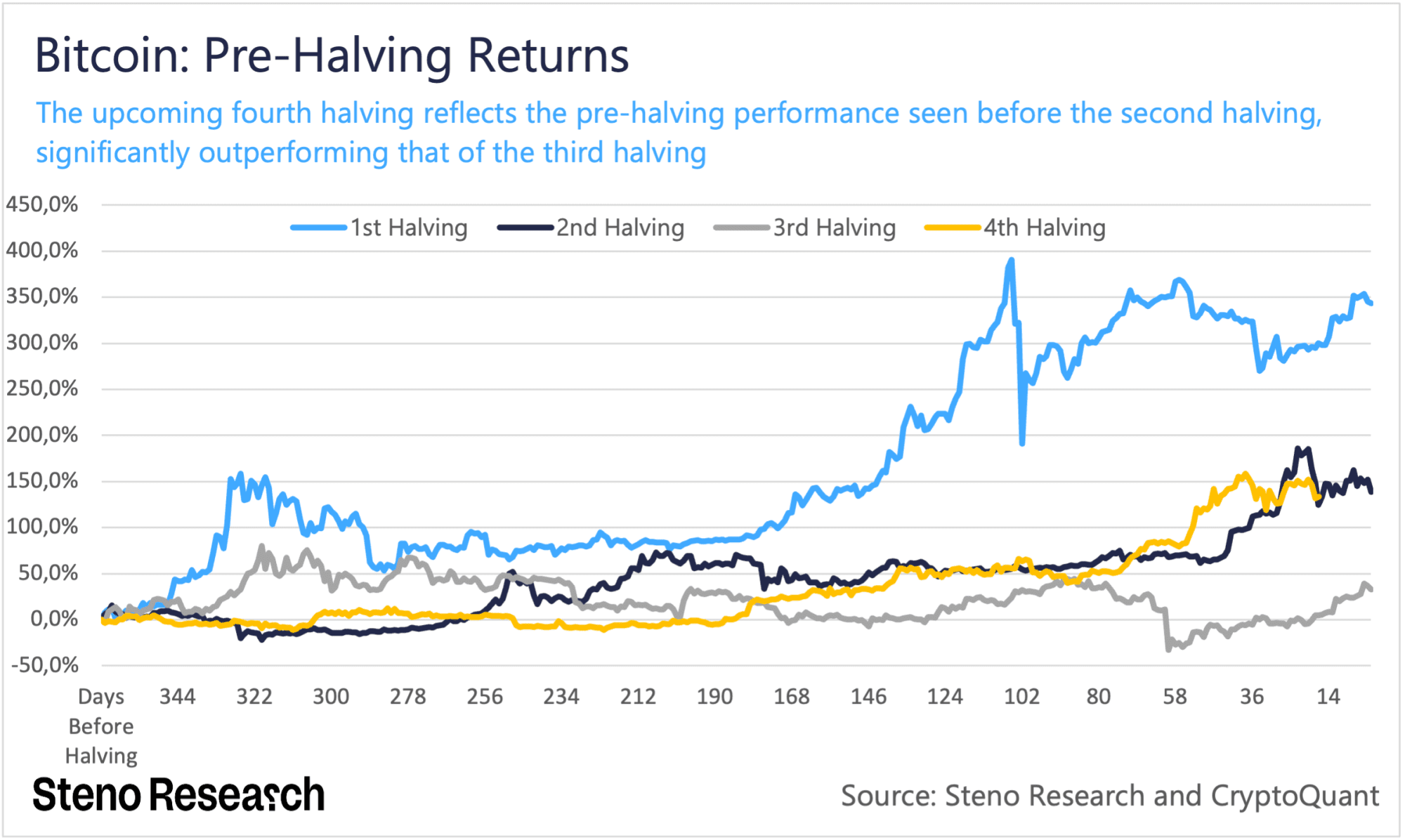

The period preceding the second Bitcoin halving holds particular significance as we anticipate the fourth halving. The price trajectory of Bitcoin in the year before the second halving in 2016 was notably more positive compared to the year leading up to the third halving in 2020, where it actually entered negative territory until about a month prior to the halving event.

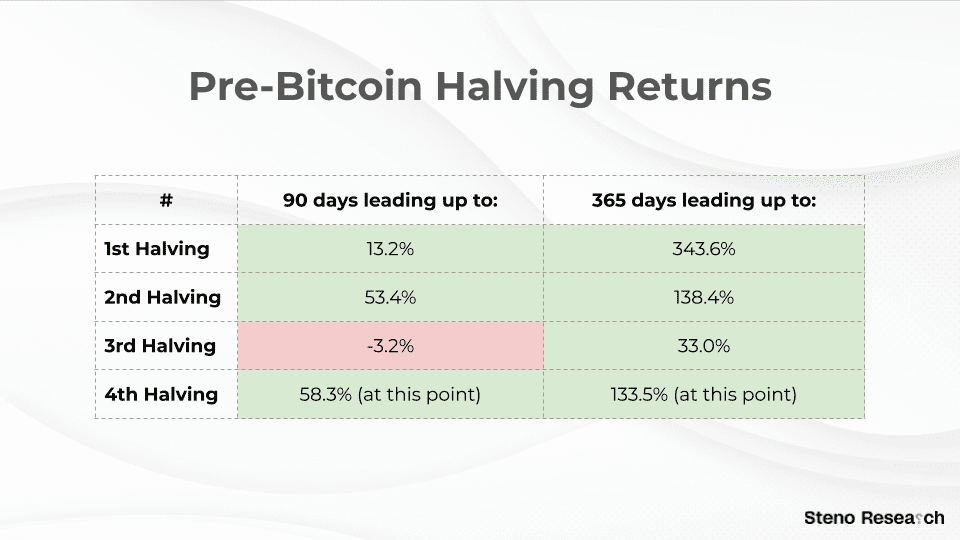

Chart 8: Pre-Bitcoin Halving Returns

The circumstances leading up to the second halving closely resemble those we see today as we approach the fourth halving, as indicated by the price data in Charts 8 and 9. Specifically, the year and the subsequent 90 days leading up to the upcoming halving have shown extremely positive trends, similar to the second halving in 2016 but in contrast to the most recent halving in 2020. The latter, however, showed much more positive price development post-halving.

Chart 9: Pre-Bitcoin Halving Returns, Simplified

The parallel between Bitcoin’s current trajectory and its performance leading up to the 2016 halving is fascinating, particularly because it may indicate similar outcomes following the upcoming halving. In Crypto Moves #2 from mid-November last year, we highlighted our expectation that the halving could become a “buy the rumor, sell the news” event. This anticipation was partly due to the unprecedented level of attention the forthcoming halving was receiving already at that time, much more so than in the lead-up to the 2020 halving.

Back in 2020, halving discussions were relatively underground, but now, the topic seems to be on the tip of everyone’s tongue, with journalists frequently bringing it up over the past six months. This surge in interest has been particularly driven by the buzz around Bitcoin ETFs in recent months.

Given the Bitcoin price’s resemblance to its behavior before the 2016 halving, which led to a ‘buy the rumor, sell the news’ event, and considering the increased attention on this halving – particularly from those invested in Bitcoin ETFs – we are highly confident that the fourth halving will exhibit a similar pattern. Our previous prediction that Bitcoin ETFs would trigger a short-term ‘buy the rumor, sell the news’ event, mainly influenced by Grayscale’s Bitcoin holdings, was proven correct although many did not believe it. We anticipate our current forecast will prove accurate as well.

To clarify our stance moving forward, we are anticipating an uptick in Bitcoin’s price leading up to halving over the next couple of weeks, as outlined in this Monday’s edition of Crypto Crisp. However, our projections suggest that for the majority of the first 90 days following the halving, Bitcoin’s price is likely to dip below its price at the time of the halving, including at the 90-day mark itself.

Yet, it is crucial to emphasize our optimistic long-term perspective: the halving is profoundly bullish for Bitcoin. We expect the anticipated reduction in selling pressure from miners to fundamentally bolster Bitcoin’s price. We believe the real bullish momentum of the halving will become apparent once the initial market adjustments have settled, and the “weak hands” – those investors who bought in anticipating quick gains, including some ETF investors – have exited. The long-term beneficial effects of the halving on Bitcoin’s price are expected to materialize after this early phase of downwards pressure.

2 Comments

Interesting article, but I think you could have researched a little more broadly, for example there should be a number of BTC ETFs in Hong Kong this month, maybe this is where the Chinese will come in and get involved, and China is the world’s second largest economy, and has quite a few billionaires; there is an ETF coming in Australia and Brazil, I have heard talk of BTC ETFs in Singapore. There is also talk that investment funds in many countries will open up to include Bitcoins in their allocations, and there is probably a lot I haven’t heard of.

I don’t know if BTC will fall or rise in the 3 months after the halving, but I think it’s a bit cheap to “just” look at previous halvings, without dealing with the big “vacuum cleaner”” of Bitcoins, like the first ETF’s is proved to be.

When we look back 90 days after the halving, and if Bitcoins are up, relative to the price on the day of the halving, then at least we know that part of the reason may be the limited analysis that “only” included previous halvings, and not the significant influence that ETFs have already proven.

As a paying subscriber, the article would have been a more valuable read for me if it had included an analysis of the possible importance of current and future ETFs and investment funds planning to include Bitcoins. Perhaps the attitude is that it is unimportant, but it is also an interesting consideration…

Anyway keep up writing interesting articles – I don’t share the view of the platform for crypto allocation, but it is always interesting to read the viewpoint from others 🙂

Hello, Villads,

Thank you for reaching out and especially for your feedback.

To put it succinctly, we don’t consider the impact of various ETFs to be crucial in the short term. This is largely because the surge in interest towards ETFs has also heightened awareness around the halving event more than ever before. We believe that the market, to a greater extent than previously, has already factored in the effects of the halving, particularly among more traditional investors via the ETFs. These investors must experience on their own that the halving is not key to endless returns.

We don’t foresee any ETFs significantly altering this situation in the coming months, which is why we chose not to delve into this topic extensively.

That said, we remain highly optimistic about the potential of these ETFs in the long term. In the upcoming edition of Crypto Moves this Thursday, I’ll be discussing the various forthcoming ETFs. I appreciate the idea.

Thank you,

Mads