Crypto Moves #23 – The Bitcoin ETFs Run the World

2024 stands out as the landmark year for exchange-traded crypto products, especially those related to Bitcoin. After years of existing somewhat separately from traditional finance, the crypto market is finally being recognized as a legitimate part of the broader financial landscape.

The United States set the stage in January by securing approval from the US Securities and Exchange Commission (SEC) for the first US-based Bitcoin spot ETFs. To any observer, it is unmistakably clear that the United States has triggered a wave of global approvals for exchange-traded crypto products. The US has essentially sparked a blaze that shows no signs of diminishing. This trend among countries mirrors the institutional adoption of digital assets, as highlighted in Crypto Moves #6. It is not just institutions; countries too are no longer hesitant about leading the way in crypto. Instead, their concern now lies with the risk of being left behind.

In this note, we delve into the most recent and significant developments in the realm of exchange-traded crypto products. We begin with the newly-launched US Bitcoin spot ETFs, which began trading exactly three months ago from today.

Strong but unpredictable US Bitcoin ETF flow

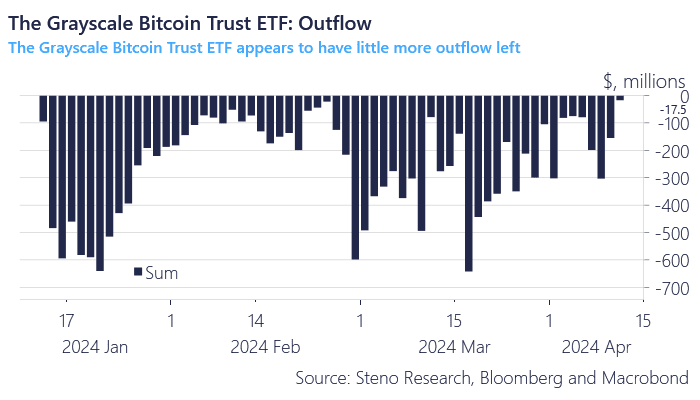

As previously forecasted in Crypto Moves #3 and other analyses, the Grayscale Bitcoin Trust ETF faced significant selling pressure from the outset due to a substantial number of bitcoins effectively being stuck within the trust.

Since the Bitcoin ETFs commenced trading on January 11, the Grayscale fund has witnessed a total outflow of nearly $16 billion. Remarkably, the daily outflow from the Grayscale Bitcoin Trust ETF reached its lowest point yesterday, at just $18 million. This suggests that the ETF has nearly rid itself of the most eager sellers.

Chart 1: The Grayscale Bitcoin Trust ETF: Outflow

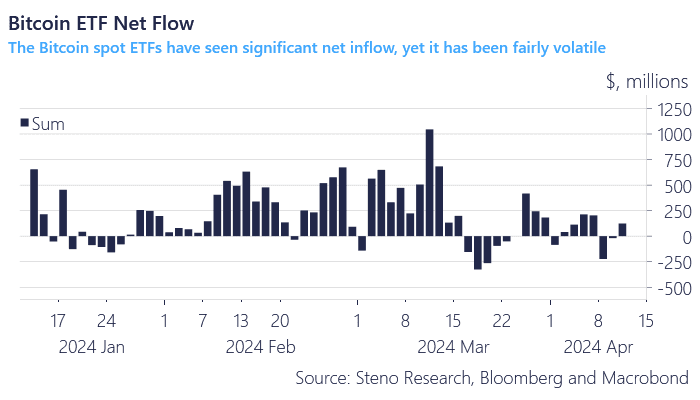

Despite Grayscale’s Bitcoin ETF experiencing a significant outflow of nearly $16 billion since January 11, the collective Bitcoin ETFs have still managed to attract nearly $12.5 billion in new investments. This achievement is particularly remarkable, given the short timeframe and the considerable outflow from Grayscale.

However, as highlighted in the second chart, the overall net flow remains unpredictable on a day-to-day basis. Recently, there has been a semblance of stabilization in these figures, albeit not at the initially high levels of inflow. We expect the depletion of Grayscale’s Bitcoin ETF not only to lead to higher net inflow but also to more consistent day-to-day inflow.

Chart 2: Bitcoin ETFs Net Flow

Looking ahead, forecasting a quarterly net inflow of $12.5 billion, similar to the performance observed over the past three months, does not seem overly optimistic. This would translate to an annual inflow of $50 billion.

Certainly, the initial surge in inflow can be attributed to the novelty of the ETFs, drawing investors who had been waiting on the sidelines. Although this initial effect is unlikely to recur, the expected decrease in Grayscale’s outflows, combined with an increase in trading platforms for financial advisors facilitating Bitcoin ETFs, should sustain a steady flow of capital. If our projections of an annual inflow of $50 billion prove accurate, we can confidently argue that a Bitcoin price of $70,000 is significantly undervalued.

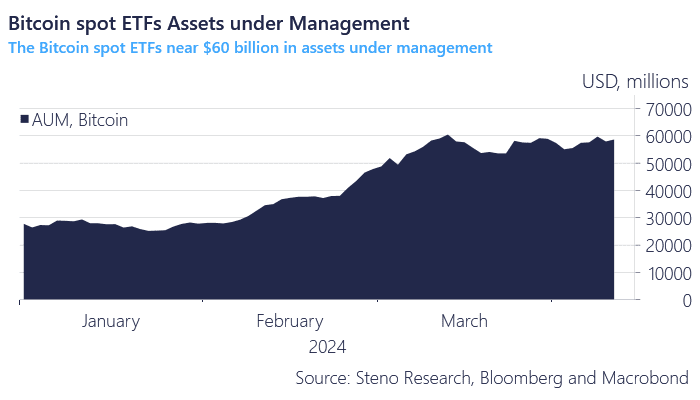

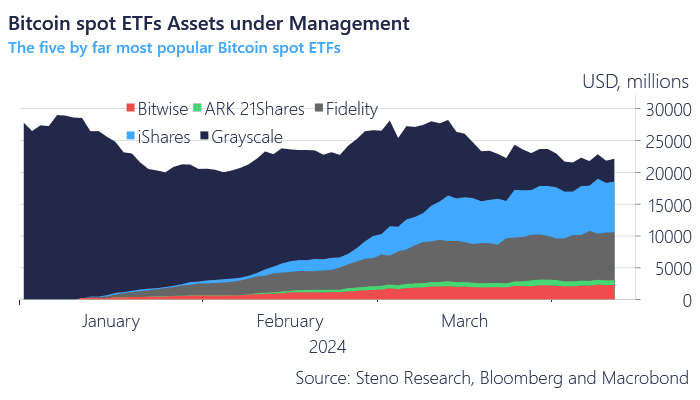

The combined assets under management for the Bitcoin spot ETFs now stand at nearly $60 billion, with five ETFs – namely Grayscale, BlackRock’s iShares, Fidelity, ARK and 21Shares, and Bitwise – being the primary contributors. Although Grayscale’s ETF currently holds the largest share, BlackRock’s iShares Bitcoin ETF, which has seen a significant inflow over the past three months, is likely to surpass it soon.

Chart 3: Bitcoin ETFs Assets under Management

Chart 4: The Leading Five Bitcoin ETFs

Since their debut three months ago, the US-based Bitcoin spot ETFs have attracted a significant inflow of capital, totaling $12.5 billion. The momentum does not stop here, with additional countries poised to roll out their own exchange-traded Bitcoin products.

0 Comments