Crypto Moves #10 – Next, Ethereum

The crypto industry’s big dream has become a reality. The US Securities and Exchange Commission (SEC) gave the green light to 11 Bitcoin spot ETFs after the market closed yesterday. Notably, this includes approval for BlackRock’s iShares Bitcoin Trust and the conversion of the Grayscale Bitcoin Trust into an ETF.

In a nutshell, the Winklevoss twins (yes, the ones from The Social Network) first tried to launch a Bitcoin spot ETF in 2013, but the SEC rejected their attempt, along with all others in the following decade, mainly due to concerns about market manipulation.

In October 2021, the SEC surprisingly approved Bitcoin futures ETFs, a different breed compared to spot ETFs. Unlike the latter, which is backed by actual bitcoins, futures ETFs revolve around futures provided by CME Group. These futures are not ideal for long-term holding due to significant rollover costs, especially in bull markets.

Fast forward to June 2023, when BlackRock, the world’s largest asset manager without prior crypto products, unexpectedly filed for a Bitcoin spot ETF. It is reasonable to assume that someone tipped off BlackRock about the opportune timing. Two months later, the SEC lost a court case against Grayscale, the world’s largest crypto asset manager, regarding the conversion of its Bitcoin trust to an ETF. This compelled the SEC to rethink its previous rejections.

These events underscored that the approval of Bitcoin spot ETFs was not a matter of “if” but “when.” And that “when” is now. Approved on January 10, 2024, with trading set to start today. We will not delve into more history lessons; instead, check out Crypto Moves #3 for a detailed analysis of the ETFs and their likely impact.

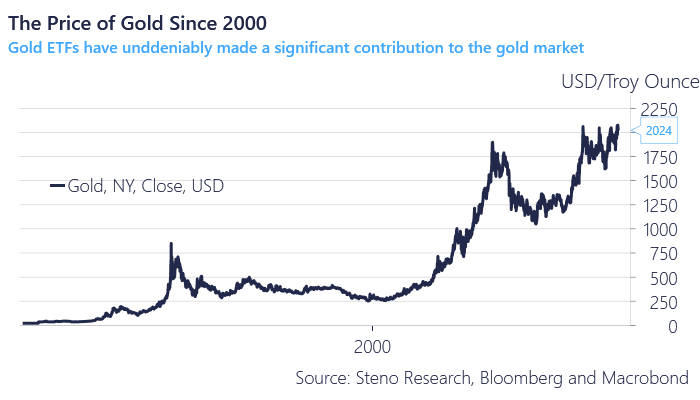

Before you read further, it is crucial to note that we see spot ETFs as exceptionally bullish in the long term. They open the floodgates for new capital, allowing institutions, hereunder asset managers and financial advisors, and retail investors to allocate capital to Bitcoin in a cost-effective and well-regulated structure. This shift is comparable to when the first gold spot ETF launched in the US in 2004, unleashing a decade-long surge for gold. We anticipate a similar trajectory for Bitcoin.

Chart 1: The Gold Price since 2000

“Buy the rumor, sell the news”

Now, let us dive into what you might be interested in – what to anticipate in the near term.

In recent months, we have taken a position on the Bitcoin ETF that goes against the consensus.

While the approval of the Bitcoin spot ETF did not spark a significant reaction in the market for Bitcoin, Ethereum emerged as the clear winner, securing a substantial 15% gain over Bitcoin post-ETF approval. Our expectation is that Ethereum stands to reap further rewards in the coming months, while Bitcoin experiences slow bleeding.

0 Comments