Crypto Nugget: Here Comes the Ethereum Spot ETF

Usually, I do not publish anything on Tuesdays, nor do I wake up at 5 AM.

Today, I am making an exception for both.

You probably already know why. If not, or if you need a refresher, here it is.

Last evening, Bloomberg’s Senior ETF Analyst, Eric Balchunas, posted on X that:

“Update: @JSeyff (James Seyffart, likewise ETF Analyst at Bloomberg) and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they’d be denied). See Nate’s tweet below for probably order of events (but again we capping at 75% until we see more, e.g. filing updates).”

Shortly after, Eleanor Terrett, a journalist at FOX Business, also confirmed this on X, stating that:

“🚨NEW: An issuer source tells me re the spot $ETH ETF development:

Things are “evolving in real time.”

These three individuals have been incredibly informative about the Bitcoin spot ETF approval process, clearly having strong sources among the ETF issuers, meaning that above was right away very believable.

An hour later, CoinDesk published a story stating that exchanges are being asked to update 19b-4 filings on an accelerated basis by the U.S. Securities and Exchange Commission, according to three people familiar with the situation.

A few hours later, Balchunas posted on X that:

“Hearing the SEC wants revised 19b-4s returned to them by 10am tmrw morning (based on a bunch of comments they just received today) for likely approval as soon as Wed.”

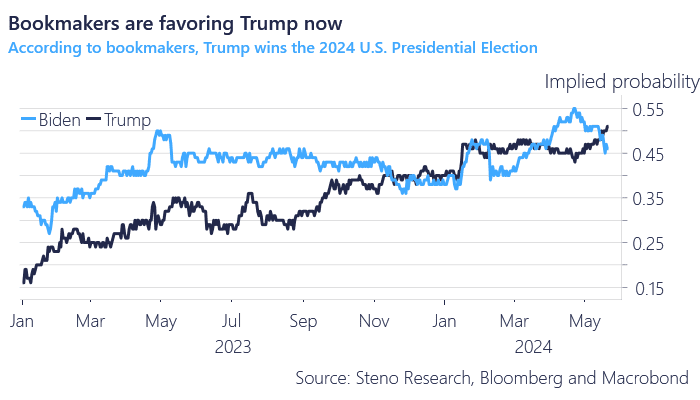

In our Crypto Moves #28, published on Thursday, we argued that the upcoming U.S. Presidential Election and Trump’s unexpected pro-crypto stance are putting pressure on President Biden to adopt more crypto-friendly policies. Contrary to popular belief, we suggested that this could become evident as early as this week. The approval of an Ethereum spot ETF would provide Biden with the perfect opportunity to demonstrate, like President Trump, that he is a genuine advocate for crypto. This move could attract voters in what is expected to be a very close race to become the 47th President of the United States.

Chart 1: Bookmakers’ Trump vs. Biden

Specifically, we wrote:

This close race (between President Biden and President Trump) might pressure Biden to attract voters, potentially by publicly supporting crypto and demonstrating a genuine commitment rather than continuing the regulatory crackdown his administration has pursued in recent years. With less than six months until the election, Biden’s window to effect change is narrow but significant.

In a week, Biden will face a prime opportunity to show he might now be a genuine advocate for crypto by pushing the SEC to approve the Ethereum spot ETF. However, it seems highly unlikely that such an initiative would directly come from Biden, especially considering his recent statement about vetoing a resolution intended to overturn the SEC’s controversial accounting policy on crypto custody, known as SAB 121. The resolution, which is likely to pass today given enough Democratic dissent against the current anti-crypto stance, will test Biden’s position once it reaches his desk.

If Biden indeed vetoes the resolution, siding with SEC Chair Gary Gensler, then we should not expect his support for the Ethereum spot ETF.

Yet, it is not entirely out of the realm of possibility, especially given the influence of major players like BlackRock. If Larry Fink, co-founder and CEO of BlackRock, were to advocate for crypto’s potential electoral leverage next week, Biden might reconsider. The power of such corporate leaders, especially BlackRock’s Fink, was evident with the approval of the Bitcoin spot ETF.

This appears to be exactly the case. Biden, his administration, and his advisors have arguably become nervous in recent weeks that Trump would attract all the pro-crypto voters. Then, they called the SEC yesterday, and not least, SEC Chair Gary Gensler, to ensure that they approve the Ethereum spot ETF. It has likely also played a role that Biden’s campaign has received significant funds from various crypto companies and donors.

It is not an exaggeration to say that the tables have really turned on this matter from one minute to the next. We are extremely confident that the Ethereum spot ETF will be approved now.

On February 15, in Crypto Moves #15, we estimated a 90% likelihood of Ethereum spot ETF approval this year, in which analysis we also argued for the fact that the Democratic Party, including President Biden, would not risk turning away such a significant voter base by blocking Ethereum ETFs, especially given the clear demand for such products.

On April 11, we lowered the likelihood to 60% due to the lack of interaction between the SEC and the issuers.

Now, we have increased the likelihood of approval to 95% for this year. Biden and his administration clearly wants it to be approved, as they view it as something that can advance Biden in the 2024 Presidential Election.

We expect approval either tomorrow or Thursday after the U.S. equity closure. It is, however, important to note that even though the ETFs are approved this week, they may not necessarily be launched the day after, as it can take months. Is it, though, the case that if they are approved, then the launch of the ETFs are more about when not if.

Tonight following U.S. closure, we may see revised filings by the ETF issuers, indicating that they are, in fact, discussing this matter with the SEC, in which process the SEC advises them to make changes to their applications, similar to the process of the Bitcoin spot ETF. Fidelity has already today removed the staking of the underlying from its application, although it is not necessarily due to communication with the SEC.

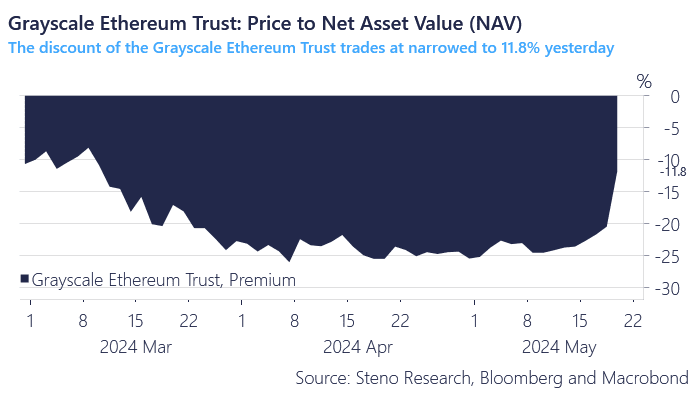

It is not only us that expect approval this week, as the discount of the Grayscale Ethereum Trust narrowed yesterday to 11.8% from nearly 25% last week. Expect it to turn even closer to 0% discount in today’s trading session.

Chart 2: The Grayscale Ethereum Trust: Price to Net Asset Value (NAV)

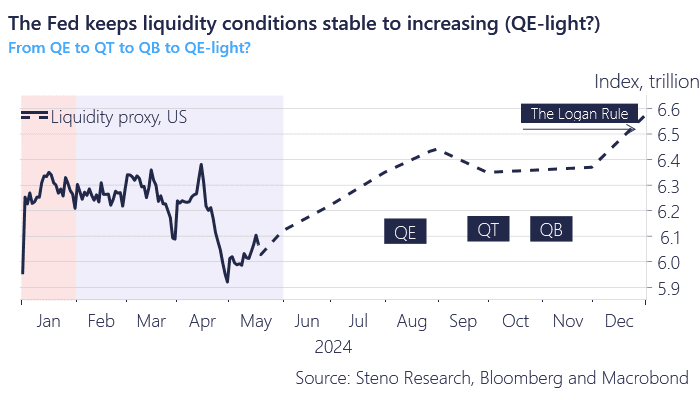

As discussed in yesterday’s Crypto Crisp, we have become less bearish in recent days, mainly due to an improving macro environment, particularly the imminent increase in economic liquidity, along with the crypto market’s weekend momentum, which did not appear to be driven by excess leverage. Additionally, Bitcoin ETFs experienced substantial net inflows last week.

However, we largely missed any compelling crypto narratives in the near term, such as the significant roles that the Bitcoin spot ETF and the Bitcoin halving have played in fueling the crypto market’s rally over the past year. Additionally, there is the seasonal trend of crypto working against the market, as mentioned in Crypto Moves #26. Given our focus on the negative crypto-specific factors over the positive macroeconomic conditions, we remained more bearish than bullish.

But now, we have exactly what we were looking for: crypto-specific narratives that can propel us much higher. The Ethereum spot ETF will be a powerful narrative, similar to how the Bitcoin ETFs have been among the strongest narratives in years.

Furthermore, the shift in President Biden and his administration’s stance on crypto suggests that we may be looking at a much more favorable regulatory environment in the US. This potentially signals the end of the regulatory crackdown on crypto in the US, opening the market to more retail and institutional investors, along with more and greater use cases and applications. This is, by itself, a compelling narrative.

Combining these narratives with the imminent improved liquidity conditions expected in July and August, we are poised for a significant rise in the second half of 2024. We have changed our market view to bullish.

Chart 3: Liquidity conditions to improve in July/August especially

This improvement in liquidity conditions, along with a more friendly regulatory environment in the U.S., will undoubtedly benefit Bitcoin. Bitcoin already has its own U.S.-based ETFs, which are likely to continue attracting substantial inflows, especially as liquidity increases.

If we are correct about the imminent launch of Ethereum spot ETFs within the next few months, Ethereum is poised to have its own ‘Bitcoin spot ETF’ moment, similar to Bitcoin’s recent experience, while also benefiting from increased liquidity and a more favorable regulatory environment. Additionally, Ethereum benefits from increased onchain activity, which is likely to rise in an economic environment with increasing liquidity. You find much more on this matter in our Crypto Portfolio. This leads us to anticipate that Ethereum will surge substantially more than Bitcoin, reaching a projected price of $6,500 by October.

If the Ethereum ETF is approved, we expect the ETH/BTC ratio to surge to 0.06 ETH/BTC in the next few months, before the ratio should reach at least 0.065 ETH/BTC later in the year. In other words, we are extremely bullish on ETH/BTC. That being said, the conversion of the Grayscale Ethereum Trust to an ETF is very likely to result in substantial short-term selling pressure, which is estimated to last for at least a few weeks.

0 Comments