Crypto Moves #15 – 90% Likelihood of an Ethereum Spot ETF Approval This Year

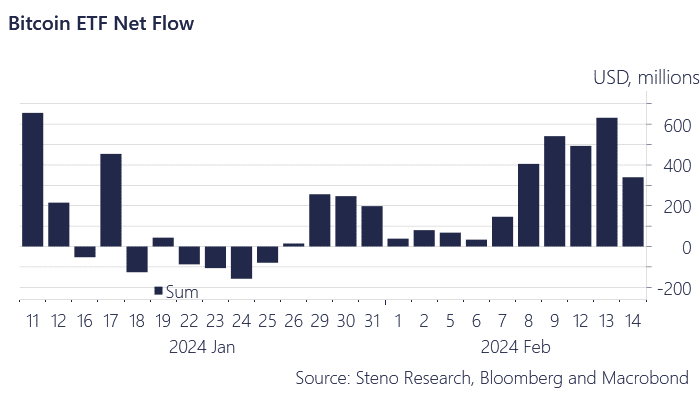

It has been just over a month since the first Bitcoin spot ETFs hit the market on January 11th. The initial weeks saw a slow start in terms of net inflow into these ETFs, mainly because investments into the two Bitcoin ETF titans from BlackRock’s iShares and Fidelity were lower than expected. This situation was made worse by the significant outflow from Grayscale’s Bitcoin Trust ETF.

However, a few weeks ago, we saw a dramatic shift. Recently, the rate of inflow has surged, with some days seeing net inflows of $500 million or more. This week alone so far, Monday through Wednesday, saw total inflows nearing $1.5 billion.

Chart 1: Bitcoin spot ETF Daily Net Flow since Inception

If you had told us two months ago that Bitcoin ETFs would witness such substantial net inflow so soon after their launch, we would not have believed you. Yet, this is our current reality. If this trend continues, it is hard to predict just how high the price of Bitcoin could go. It might sound like hype, but it is difficult to overstate the potential impact on Bitcoin’s price by these ETFs.

Let us assume the net inflow averages around $1.5 billion every week, or $300 million per trading day, which is a conservative estimate compared to this week’s performance so far. This would effectively remove approximately 28,600 bitcoins from the market each week. To put this into perspective, miners generate about 6,300 bitcoins weekly, which they often sell off quickly to cover their operating costs. This consistent selling by miners, who are arguably the largest constant sellers in the Bitcoin market, has significantly pressured Bitcoin’s price during the recent bear market, a point emphasized in Crypto Moves #2.

According to this estimate, the ETF inflows counteract the miners’ selling activity by a factor of 4.5. With the miners’ rewards scheduled to halve in about two months during the upcoming fourth ‘halving’ event, the significance of this impact is poised to increase even further.

We have a high level of confidence that the US will witness the launch of an Ethereum spot ETF within this year, assigning a 90% probability to this event. Our optimism is grounded in five key reasons. We have every reason to believe that an Ethereum spot ETF will be just as successful as the Bitcoin spot ETFs have already been.

0 Comments