Asset Allocation Watch: Country Garden melt-down? 5 charts on cross-asset spill-overs!

Good evening from Copenhagen.

We will have a 100% focus on China this week at Steno Research with the launch of our China week and the Premium Q&A Session on Wednesday. Invites are already distributed to your calendar or else please contact us at [email protected] (Premium clients only).

We have spent this Sunday evening trying to prepare ourselves for the opening given the turmoil expected in China after Country Gardens (the former largest developer) is to suspend trading of at least 10 onshore bonds after a week where they failed to pay coupons of a couple of international payments.

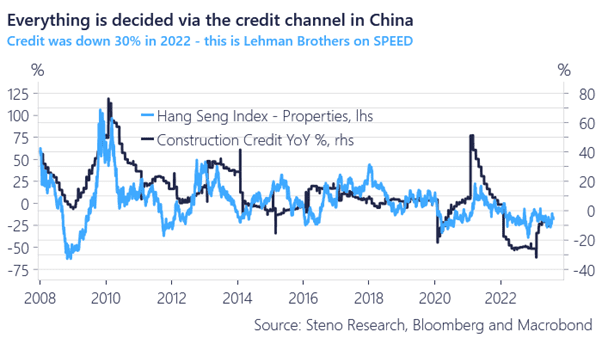

The Hang Seng Property Index (HSP) is down 20% y-t-d but only lost 0.2% on Friday despite another landslide in the Country Garden stock. Country Garden is not as important on a stand-alone basis anymore, so everything is now about the broader repercussions.

If the HSP Index drops over the coming days, it ought to be taken as a signal that Chinese RE credit will decline further due to a lack of confidence in the financial system. This will likely, at least short term, have global implications.

Let’s look at how assets typically react when the Chinese RE sector takes a beating. The below is a set of Beta studies. They show the “expected move” if the Chinese RE sector gains 1%, why you should see conclusions upside down.

This is a pure data study and not necessarily reflective of how we view the situation. Read our editorial from earlier to gain an understanding on that here.

Find out more with a free trial below!

Chart 1: The HSP index is a decent live proxy of RE credit growth/declines in China

Which assets will be on the move if the Chinese RE meltdown continues on Monday? We have gathered the empirical evidence in this short but data-heavy piece. Best of luck for trading during the week ahead!

0 Comments