The Energy Cable #19 – Watch out for temperatures to be a joker in Nat Gas markets

Welcome back to the Energy Cable, where we as usual keep you updated on the latest trends within energy markets. While both the oil and gas price seems to have stabilized (for now), what is the outlook for the time to come? Follow along in this piece, where we take you through our price models of oil and gas to assess where markets are heading next. We present 2 different views.

Steno Research: Following up on McKinsey

Mckinsey, one of the world’s finests at talking hot air and charging you at the same time, made a detour from “strategy consulting” into the great macro circus with its piece on the European natural gas situation. Having spent a wee bit of time on the topic ourselves, we of course thought it would be appropriate to follow up on McKinsey with our own piece of the drivers of the European gas situation.

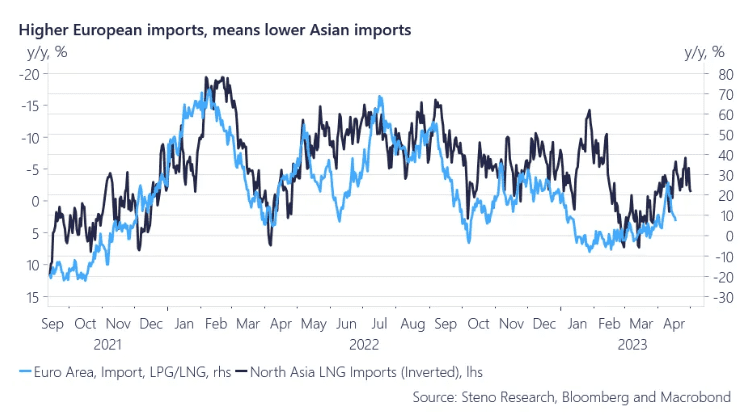

Firstly McKinsey flags Asian LNG demand as having an influence on European prices. We find the same correlation and add that Europe has shown its ability to price out Asia should European LNG demand rise. McKinsey assumes the same level of imports in 2023 as 2022 for Asia. Currently our data suggest that Asia in the first 3 months of this year has bought 28% of its imports relative to its total 2022 imports. We further note that LNG prices in Asia are down 25 USD/MMBtu measured y/y. We lean towards further downside pressure in Asian LNG prices, which alleviates potential inflationary pressures.

Even the scarcity of energy will probably not bring bullish price-action back to natural gas markets, while the outlook for oil is brighter. Can oil and gas crush the obstacles that they are faced with? Find out in this version of the energy cable, where Warren and I as usual don’t quite agree.

0 Comments