Steno Signals #115 – The head-fake business cycle strikes again

Happy Sunday from Copenhagen.

Almost exactly a year ago, we wrote about the “roadmap to a recession” and how the market wrongly anticipated a near-term recession going into 2025. We also labeled the increasing re-inflation and manufacturing momentum a head-fake during the spring as the credit growth never truly supported a comeback to the most cyclical parts of the economy.

At some point during the first half of the year, we started getting a little worked up about the momentum that was building, but we are now seeing clear signs of a reversal, not least in China.

We are therefore increasingly convinced that the Manufacturing rebound and the inventory build-up in H1-2024 was a headfake.

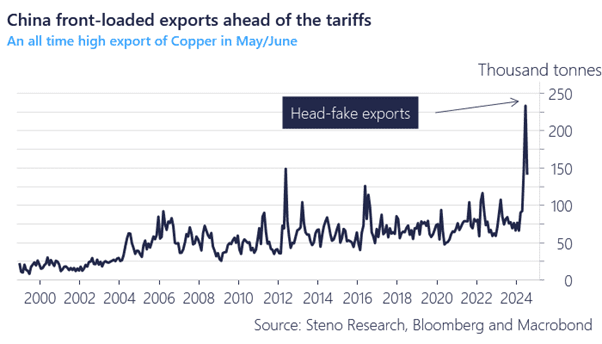

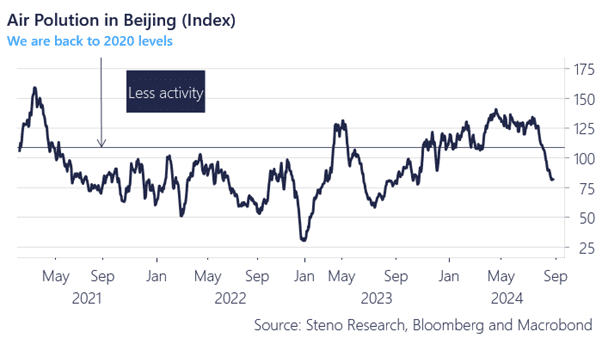

Judging from export- and activity numbers in China, we saw a major “head-fake” build up of export- and manufacturing momentum ahead of the tariffs, and we are now on the other side of that front-loading meaning that both are normalizing/receding at a fast pace.

China has come to a sudden halt, and it is likely a warning signal for the Manufacturing outlook.

Chart 1a: Chinese exports were massively front-loaded ahead of tariffs

Chart 1b: The Chinese manufacturing gauged via air pollution is falling off a cliff

The manufacturing rebound in H1 2024 was another head-fake, and we were correct in predicting that everyone would call off the recession. Now, the market is likely going to “reprice” the recession risk again.

0 Comments