5 Things We Watch – PMIs, FX, Japan, Brazil, Inflation

Welcome to this week’s edition of ‘5 Things We Watch’, where we take you through 5 things that we have found particularly interesting in the past week. Yesterday we launched the first of a couple of articles focusing on the current business cycle, giving our best guess on where in the cycle we are, what markets are pricing in and most importantly – what will happen next.

The full articles regarding the business cycle and how different asset classes are positioned for it will be released throughout the week for premium subscribers. If you want, you can always try a 14 day free trial if you’re not already a premium client.

But as always, follow along as we dissect the 5 things that we look out for.

This week we are watching out for the following 5 topics within global macro:

- Manufacturing PMIs

- Japan

- FX

- Brazil

- Inflation

1) Manufacturing PMIs

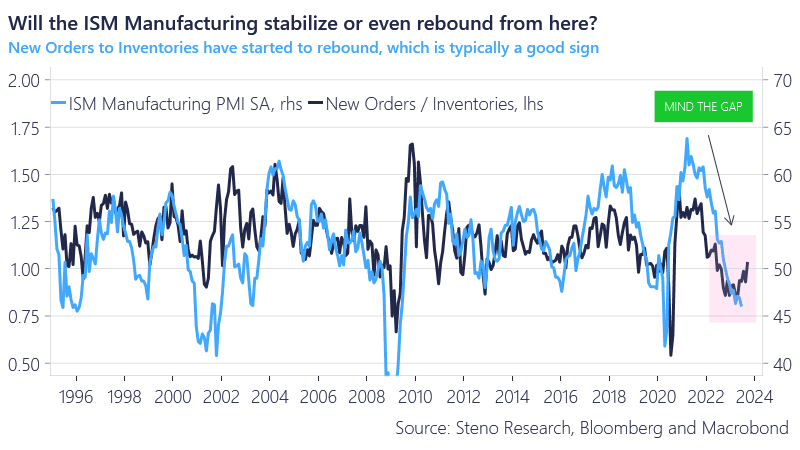

The overall economy has come back with a vengeance after the pandemic and surprised everyone with an abnormally strong labor market and stunning service sector that keeps delivering boom-like numbers, while the manufacturing sector has been bleeding moderately throughout the later stages of 2022 and 2023.

But are we in for a change now? And what does that mean for asset prices? According to the ratio between new orders and current inventories from the ISM report, manufacturing could be in for a rebound. If that’s the case, long risk gets even more favorable from a risk/reward perspective.

Chart 1: Rebound in Manufacturing?

This week our primary focus is the current business cycle, where we try to figure out which stage we are in, and what outlook different asset classes are pricing in. Today’s edition of ‘5 Things We Watch’ is no exception.

0 Comments