5 Things We Watch: Italy, Chinese reopening, Debt Ceiling, Excess Savings and FX positioning

Wednesday is finally here, and that, of course, means that we will once again give you a brief update on which macro events we keep an eye out for in the weeks to come, and how they affect asset markets. Enjoy!

This week we’ll be diving into the following 5 macro topics that are on the top of our minds at the moment:

Let’s dive straight into it and uncover the implications of the macro topics listed above.

1: Italy

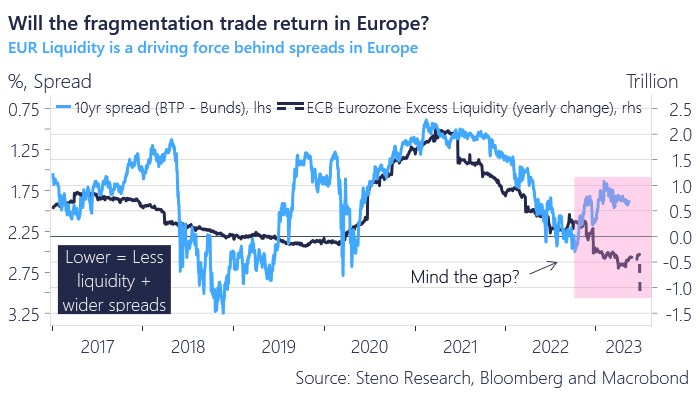

As we have told you multiple times over the past week or two, the EZ and EUR optimism is likely not going to continue from here, as the Euro Area is starting to see the first signs of weaknesses across economies – just take the Germany Manufacturing Orders as an example, which dropped 10% on the month! And it doesn’t take many economists to conclude that these weaknesses are likely to spread to other sectors and countries, of which a potential first candidate for a substantial economic setback could very well be: Italy

A setback that might be kickstarted by vulnerabilities in the Italian banking sector: While the capital ratios and general state of banks look extraordinary (from a historical perspective), Italian banks purchase domestic government bonds to a greater extent than their European peers (by far), and with Largade’s recent “we have more ground to cover” rhetoric, this exposure might turn out to be toxic for banks. Especially if our models are correct, predicting that the BTP-Bund spread will widen further, making it expensive for Italian banks to hold local govies,

Chart 1: The BTP-Bund spread is likely to widen as liquidity dwindles

What’s going on with Italian banks? How does the Chinese reopening look? What are the ramifications of a US shutdown? Will consumers run out of excess savings? And are FX crosses ready for a recession? Find the answers in this week’s edition.

0 Comments