5 Things We Watch – Central Bank Outlook, USDJPY, Natural Gas, Credit & Liquidity

Global macro never sleeps, and this week is no exception with ongoing turmoil in US equity space amidst the big 7 reporting earnings.

The last quarter of the year will most likely define how asset markets will perform well into next 2024 with USDJPY hovering just below the all important 150 handle and global central banks likely heading towards the end of their cutting cycle.

As always, we have collected 5 of the things we find to be the most important to watch in the current landscape. Enjoy!

This week we are watching out for the following 5 topics within global macro:

- Central Bank Outlook

- USDJPY

- Natural Gas

- European credit

- Liquidity

1) Central Bank Outlook

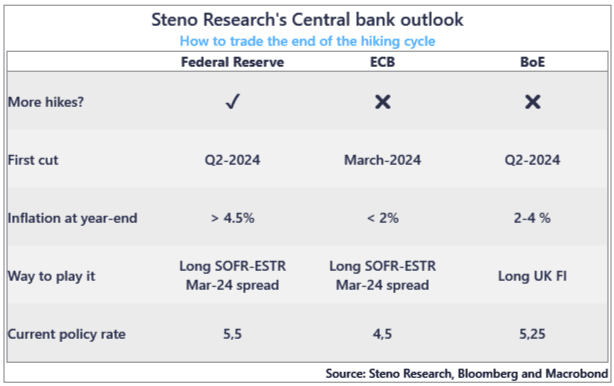

As we are likely heading towards the end of the global hiking cycle, the edge in markets is too be found in predicting when the major central banks will reverse current policy, and if more hikes are up the sleeve of Powell, Lagarde, Bailey and the rest.

We have given our best guess to how inflation and policy rates will look towards the end of 2023, and when we will see the first cuts fom the biggest central banks. Find our short take below.

Our base case:

ECB: Done, first cut in March-2024 (risks tilted towards earlier easing)

BoE: Done, first cut in Q2-2024

FED: 1 more hike, first cut in late Q2-2024 (may do some sort of QE before)

US CPI will reach >4.5% in Dec (released in Jan-24) before receding towards 2% in line with the recession call.. But not much is pointing to 2% being reached in forward looking evidence right now. EUR-flation will drop below 2% soon.

Chart 1: Steno Research, Central Bank outlook

USDJPY will probably be THE pair to watch, as a break of the 150 handle will be catastrophic for risk sentiment and the path for BoJ. Read what else to look out for in global macro in our 5 things to watch.

0 Comments