5 Things We Watch: Brazil, Italy, CNY, DAX and EU Banking Crisis

Every Wednesday we provide you with the 5 topics that we track intensively in the current environment. Today is no exception.

Italy might be the canary in the coal mine in Europe as the South European country has extensive funding issues with 650 bn. EUR worth of debt maturing within the next year amidst an ECB hiking cycle. And coupled with a potential banking crisis coming to the European continent, things are not looking bright for European equities.

On the other side of the Atlantic, Brazilian bonds may be in for a rally, and the Yuan could be in for a devaluation in response to lower oil prices.

Follow along, as we dive into the topics piece by piece:

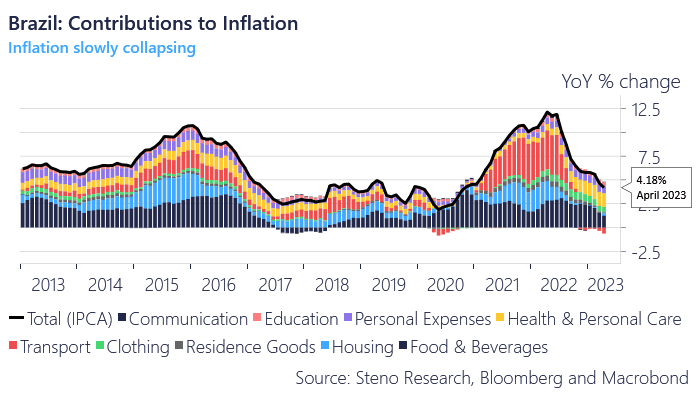

1: Brazil

In our very first EM by EM piece from the start of April, we presented Brazilian sovereigns as an overlooked asset class that would likely gain favorable tailwinds due to the nature of the current business cycle and the underlying macro fundamentals. So far, we have been spot on, and we look to stick to our initial bet for some time due to several factors – one of them being that Brazilian CPI has fallen rapidly and will continue to do so. Not strange when the central bank hikes interest rates to 12%.

Chart 1: Brazil CPI has fallen rapidly since 2022

Is Brazil a hideout in the current environment? How will Italy refinance its debt? Is it time for CNY to head lower? Have we seen the top in DAX? And will the banking crisis move to Europe? Find the answers here.

0 Comments