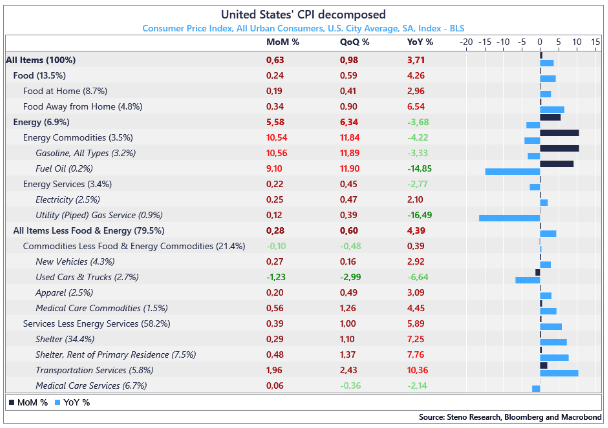

US CPI Review – 10% increase in Energy Inflation!

What a report that just dumped in our inbox. Both core and headline surprise on the upside of expectations MoM, with headline increasing from 3.2% YoY to 3.7%, while core comes in at 4.3% YoY vs 4.7% previously – the era of rising headline inflation and falling core inflation is here.

The change is mostly driven by a HUUGE rebound in Energy inflation, coming in at 5.58% MoM vs 0.11% in July, with Gasoline prices up 10.5% since last month. This is a worrying sign for Powell and his staff as the SPR is emptying, effectively leaving US Energy Inflation ultra dependent on Bin Salman and OPEC.

There are currently no signs of oil stopping its rally, and if price action trends persist in the energy space, both PPI and other components will be on the rise very soon. And this comes right as shelter is starting to turn disinflationary, which was the biggest problem in the basket previously…

Chart 1: Full CPI breakdown – Gasoline, uffff…

Energy inflation is back on the board, and it will soon spread to PPI and the other components if current trends persist. We take you through the most important take-aways from the report.

0 Comments