US Bank Watch – 3 arguments for the inevitability of more banking failures

Taking a deeper dive into the core of US banks’ balance sheets and income statements, we find multiple reasons why you should worry about more banking failures in H2. Overall, the banking crisis has nothing to do with how banks are run (with the exception of SVB), and has everything to do with the state of the banks’ clients (companies) and lenders (depositors), and these are hence the areas to study if you want to assess what’s going to happen in the banking sector from now.

Banking crises always come on the back of either: 1) Horrible loan demand or 2) Extreme deposit flights, which ultimately end in quick collapses. But at the moment, neither of the conditions can be checked off, as we are only witnessing moderately weakening loan demand and a slow withdrawal of deposits (a combination of money destruction and deposit transfers from one bank to another). A bank can do fine if only one of the legs (weakening loan demand / deposit outflows) is present, but when both are present, this results in banks slowly but surely bleeding until rates come down.

Ultimately, the killing blow of US banks will be the too-tight monetary policy, which literally destroys money from the system (as a result of fewer loans and lower credit), and adding deposit transfers from smaller to bigger banks, it will not be pretty. Read more below, as we have a look at banks’ income and deposits outlook, as well as how well prepared they are for a slowdown in activity.

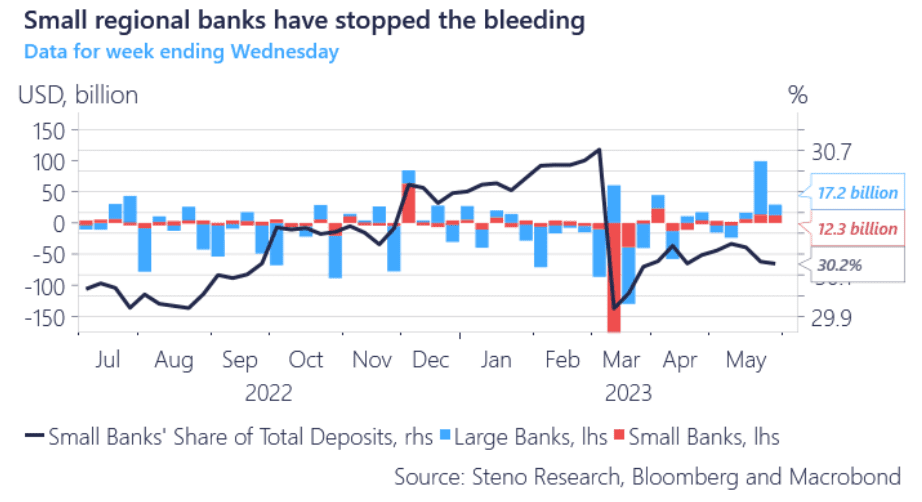

How is the deposit outlook?

Since March outflows from small banks have calmed and everything looks to have calmed down as confidence returns to the broad banking sector from its customers. Great, right? Sure, but as we lay out the case, not a lot has structurally changed since March.

Chart 1:

The higher-for-longer crowd has rightfully been celebrating as the short end of the curve has reached pre-SVB levels. We find that structurally nothing has changed and that 10 years of ZIRP being replaced by unprecedented and unpredictable rate hikes is still bound to bring more pressure on banking and here’s why.

0 Comments