UK Watch – Are UK assets a go or a nogo?

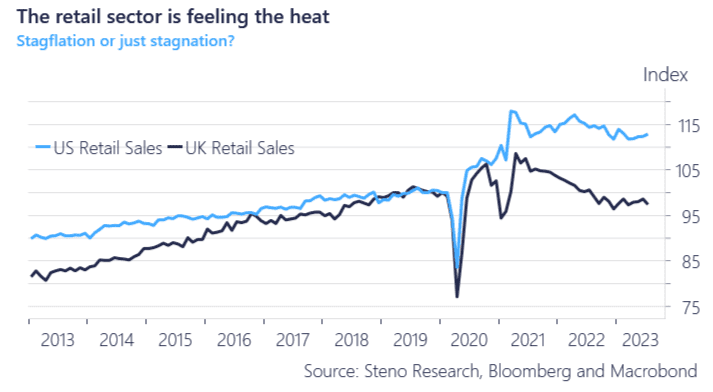

While most Western countries are experiencing inflation levels too high for comfort on the back of a stronger-than-anticipated economy, the UK is fighting 2 simultaneous battles: They need to bring inflation down, but they also need to address the question of a weakening household economy with retail sales continuing their path downwards, raising the question whether stagflation has made its way to the Island.

Let’s run through a brief view of observations found in the UK economy.

Brief run-through of the UK economy

The UK has been in a rough spot since the outbreak of the pandemic, as the fiscal framework of the UK hasn’t helped support the household, and when Liz Truss together with her companions made a fiscal U-turn on tax policy, it certainly didn’t help the issue.

Real retail sales in the UK are now around 15 index points below the US after following each other closely during the first stages of the pandemic… The multiple lockdowns imposed in the UK haltered economic activity, and the Brits are now starting to feel the effect of higher interest rates.

Chart 1: The retail sector has hit the wall

The UK has received some attention throughout the current economic cycle as they try to combat weakening growth together with inflation way above BoE’s target. Is now the time to buy UK assets, or is it still a nogo? We’ve run the numbers.

0 Comments