Something for your Espresso: The USD is on the move

Good Morning from Europe.

We hope that you have enjoyed a long weekend. Market moves post the debt ceiling optimism and increasing US/Chinese tensions mainly center around the USD.

The DXY is now trading close to 104.50 and the important resistance level around 105.60 is within reach. The USD liquidity outlook is now almost set in stone. The liquidity will dwindle due to 1) QT, 2) TGA being replenished and 3) Potential further FDIC repayments of emergency loans.

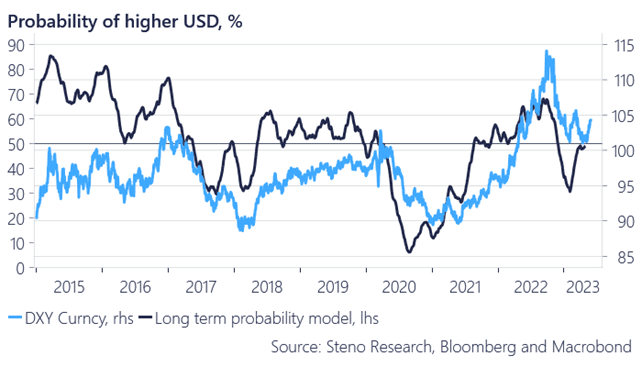

Our probability weighted macro model is yet to go all-in on the USD signal, but the needle is clearly moving in that direction currently due to 1) relative liquidity, 2) relative macro momentum and 3) relative inflation momentum.

Chart 1: The USD is getting fundamentally stronger according to our model framework

The USD remains on the move with increasing US/Chinese tensions, while equities keep reaching for the stars in Japan. European inflation numbers start coming in today.

0 Comments