Something for your Espresso: An ISM report with “pause” tattooed all over it while the RBA hikes

Good morning from Europe

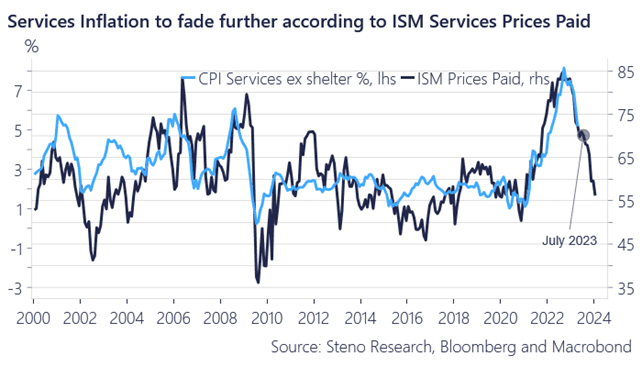

The ISM Services report had PAUSE tattooed all over it as the employment index dropped below 50, while prices paid continued to decline in momentum and now point to 2-2.5% service ex shelter inflation in just 6 months from now.

The ISM Services Prices Paid survey is one of many soft indicators on inflation now pointing to a clear disinflationary outlook. The CPI report the day before the conclusion of the FOMC meeting is the only major key figure left that could convince the Fed of NOT skipping. We see a very low risk of that by now. 6 bps are still priced in for June currently.

Chart 1: Services inflation is now likely to fade fast

The ISM Services report had “pause” tattooed all over, while the RBA hiked this morning in a surprise move. Is the RBA a harbinger for the BoJ? We also took notice of the WSJ story in increasing capital requirements for banks.

0 Comments