Positioning Watch – Low FX volatility provides cheap leverage for a rebound in manufacturing

Hello everyone, and welcome back to our weekly Positioning Watch.

Markets were caught on the wrong side of expectations last week with PPI coming in substantially hotter than expected, but equity sentiment has remained decent outside of some profit taking in Tech, as the cocktail of better liquidity conditions and a brightening economic outlook is likely to prevail – and positioning provides very decent opportunities to trade the potential comeback for cyclical assets.

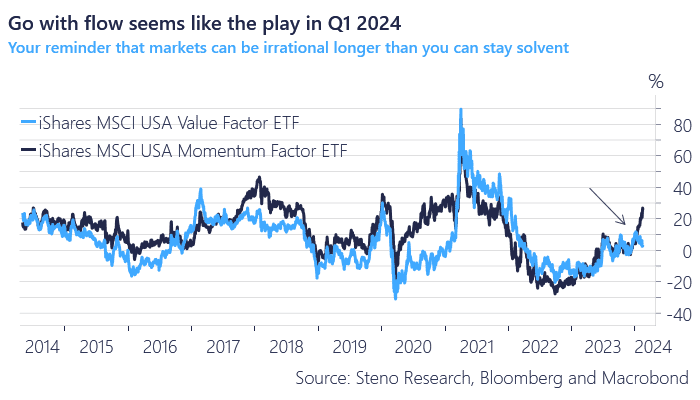

As this week’s chart of the week we present to you what looks to be the theme of Q1 2024, and the reason why right now is not a good time to be contrarian: momentum is king, and “go with the flow” currently performs WAY better than cherry-picking the good old value stocks.

Chart 1: If you want to be contrarian, timing is crucial

If a rebound in manufacturing is truly happening, current dynamics in FX option markets provide cheap leverage and good opportunities to capitalize on our trading ideas. In the equity space, broad momentum is slowly creeping back in ETF fund flows, and the early reacceleration in prices haven’t affected sentiment it seems.

0 Comments