Positioning Watch – How are markets positioned ahead of a turbulent 2024?

Hello everyone. We hope you have enjoyed the holiday season and are slowly but surely getting ready for New Years and the new year ahead of you in markets.

Our office in Copenhagen has also been mostly empty over the holidays, but we have tried to keep you posted still with small bits and pieces throughout Christmas, and today is no exception with this small piece on market positioning and sentiment for 2024. We will be back at full speed tomorrow Dec 27.

The year has generally speaking been a forecasting challenge for most to say the least, and not a lot of people forecasted the ending that we’re left with, but how does the current price action and massive inflows into both equities and bonds leave us for 2024?

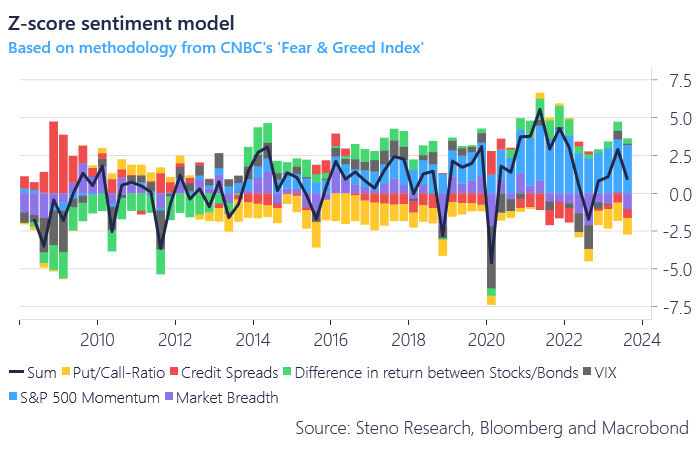

Sentiment has been EXTREMELY bullish in Q3 and Q4 based on our z-score sentiment model but almost solely built on equity momentum, which is rarely a good sign. Both option ratios, credit-spreads and market breadth have turned bearish in Q4, which should leave markets vulnerable after the boost from positive liquidity trends dwindles during Q1 2024.

Chart 1: Markets have been bullish, also relative to the post-GFC period

As we approach 2024 we have a look at 2023 in rewind and point out the main positioning themes of the year, and how investors have positioned themselves for the new year.

0 Comments