Positioning Watch – Commodities are back on, and so are cyclical equities

Finally some action from the BoJ earlier today with a 10 bps hike, in line with market expectations after it was rumored that they would tweak policy last week. The BoJ has, with barely no exceptions, leaked all their policy moves to the press before actually moving the needle, and dynamics post the meeting is nothing less than a classic “buy the rumor sell the news”. It looks like markets had hoped for some clarity on the path for the policy rate, which they weren’t given this morning (more on the BoJ meeting here).

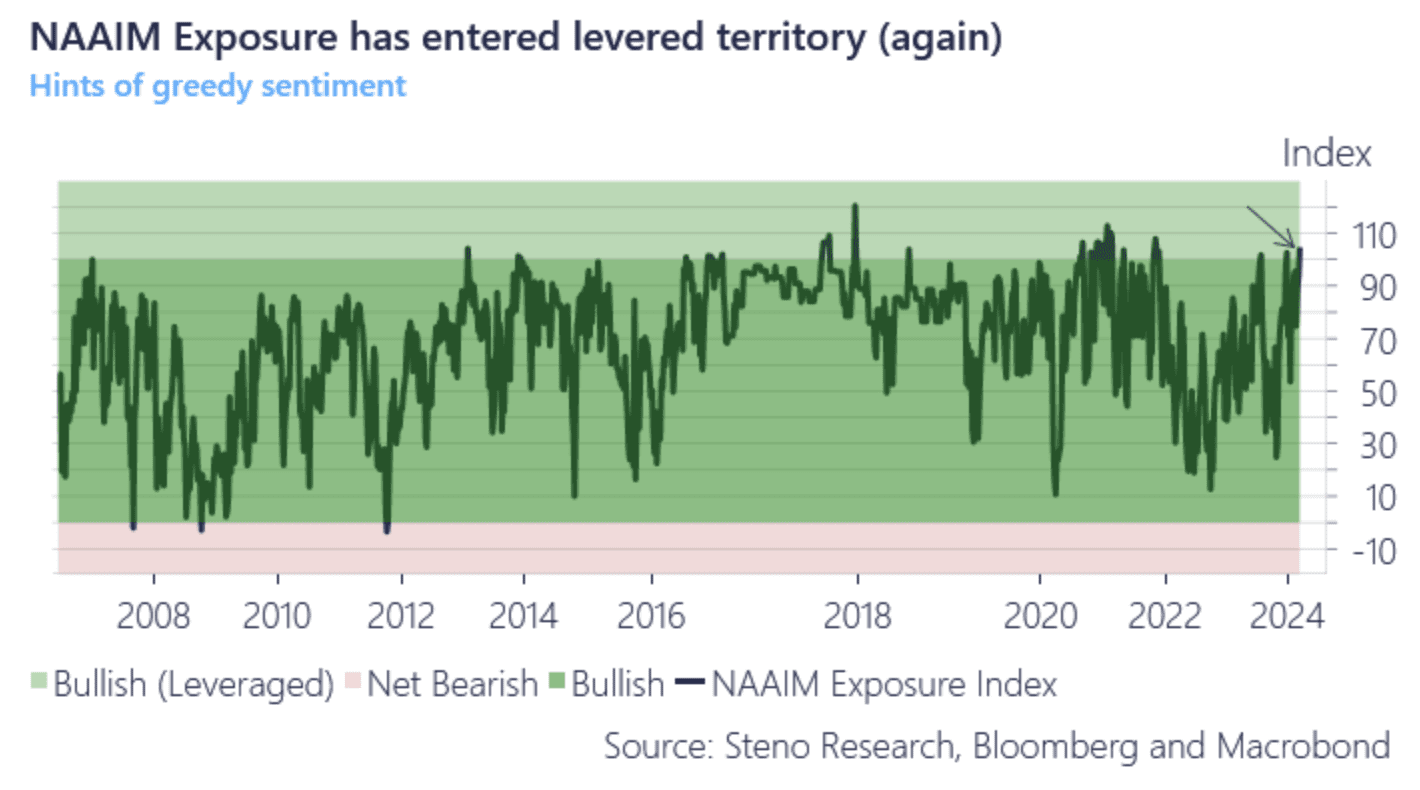

Meanwhile in equity spaces, active managers have increased their equity exposure, and we have moved into leveraged territory in the NAAIM indicator once again – a sign that the rally is still going strong, although with risks of getting overheated.

Chart 1: NAAIM Exposure back into levered territory

Market positioning is finally aligning with the trends highlighted in the past weeks, and commodity positioning is now almost outright bullish for cyclical metals, while cyclical equities are moving. Read how markets are positioned here.

0 Comments