Something for your Espresso: A BoJ classic

The last couple of normalization moves have been well-orchestrated by Governor Ueda and his ilk at the BoJ. The “flexible” cap to the YCC implemented in October 2023, did not lead the market to chase JGB yields higher as the ambiguity of the new target meant that markets had nothing concrete to chase.

We are left with the same vibes after a historic 10bp hike paired with a more formalized end to the YCC program and the ETF buying. The BoJ keeps the flexibility to intervene intact and markets have zero guidance on levels or trigger-events, meaning that we are effectively stuck in the same environment as before today’s decision. Ending YCC without ending it, seems like a smart play by the BoJ.

We also have very few clues on the magnitude and/or timing of a potential rate hiking cycle. We will learn more when the BoJ updates the “Outlook for Economic Activity and Prices” in April, which is going to be interesting given the latest solid wage rounds.

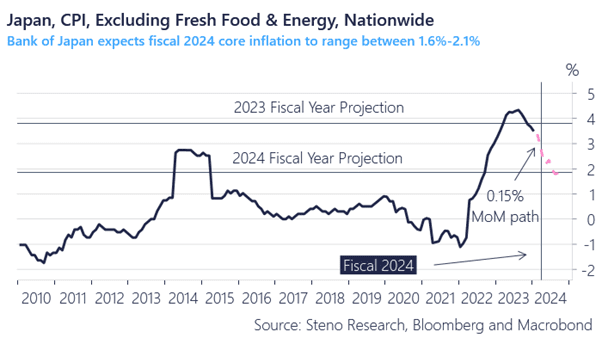

The BoJ needs a core inflation path of 0.15% MoM to satisfy their 2024 fiscal year projections on inflation, but we are still running above such levels on average in seasonally adjusted terms, even if the last three months have been nominally soft (without seasonal adjustments).

The scope to increase core inflation projections seems decent in April given the >5% Rengo/Toyota wage deals, and it will likely allow the BoJ to firm up the communication on rates in April.

Chart 1a: A path of 0.15% MoM is needed to satisfy 2024 inflation forecasts

Chart 1b: Seasonally adjusted inflation is running above target levels still

The BoJ has once again managed to move the needle without moving the market and there are few clues on the direction from here. Well played Ueda!

0 Comments