Portfolio watch #3: Resilience, resilience… more resilience?

Welcome to this week’s edition of the ‘Portfolio Watch’ where we’ll take you through the rationales behind our current positions and evaluate both leaders and laggards.

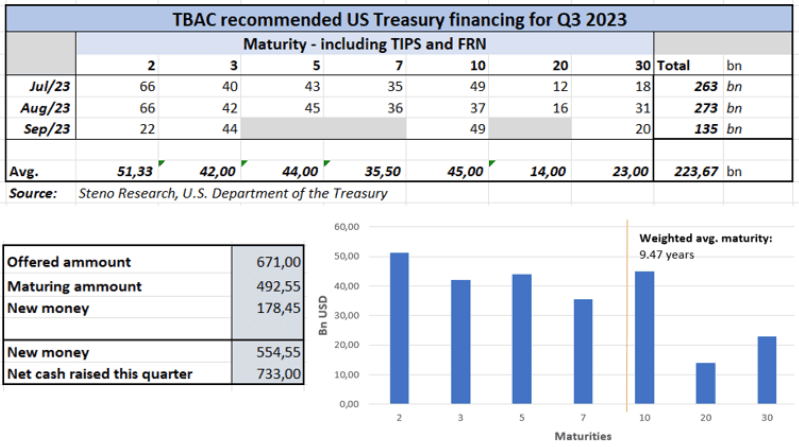

Over the course of the remainder of 2023, approximately 1.1 tn USDs in debt will be issued by the treasury, and while the ON RRP acts as a buffer, the projected liquidity withdrawal from the issuance will likely have implications for financial markets and strengthen the USD. Additionally, with its vital role as a settlement currency, it’s still pristine safe haven status, and the positive carry, we see little fundamental evidence of a weakening dollar in the current macroeconomic landscape.

Bearing in mind the worsening prints coming from Europe (EUR accounts for 57.6% of DXY), the lax Japanese policy, and a possible devaluation of the CNY made possible by cheaply imported ural, we remain upbeat on the USD. Something we covered in yesterday’s ‘US Debt Watch’ as well.

Chart 1: UST issuance to tailwind USD (Pos.: UUP)

Another great week for the Steno Research portfolio! Read along as we dissect the performance and consider our allocations going forward.

0 Comments