Out of the Box : Cut rates if you want lower inflation, Powell

In our “out of the box” series, we aim at being ahead of the current consensus narrative and think of the next theme that could drive price action before anyone else has given it any noteworthy attention or provide food for thought on topics of relevance that seem neglected by the economic consensus.

After the change in methodology to the CPI basket in 1983, interest rates aren’t reflected to the same extent as before in the inflation basket. But that also means that Americans feel rising costs of living to a larger extent than the CPI basket reflects. The below chart is a good example. Surveyed Americans’ perception of buying conditions for real estate, vehicles and large household durables still remain low, most likely due to the cocktail of inflation AND rising elevated interest rates on financing those durables.

The divergence in the two time series below underpin inflation expectations, since high financing costs for home -or car purchases automatically fuels wage demands and as financing costs form part of the perceived inflation.

If Jerome Powell wants lower inflation then cutting rates will feed into people’s perception of buying conditions and automatically lower living costs. This is admittedly almost an Erdoganish’ logic, but the idea is not 100% without merit.

Moreover, rents are typically increased in conjunction with high financing costs, which also serves as a self-fulfilling inflation prophecy.

Chart 1: Lower rates means lower perceived inflation

We take inspiration from a NBER working paper on the cost of money to create a headline inflation index in which owner’s equivalent rent has been substituted with the pre-1983 homeownership costs. The old homeownership cost index consists of the 30 year mortgage rate, the S&P/Case-Shiller Home Price Index and an interaction term between the two.

We find that the perception Americans had of the increase in cost of living was likely around 16% in YoY terms and it is very likely that Americans are still suffering from this ‘Vibeflation’. Furthermore, the basket doesn’t reflect personal interest payments and vehicle prices which were also changed in 1983, thus YoY inflation, in old terms, was likely much higher.

We furthermore see that the alternative inflation basket is now printing at close to almost 0% YoY, well below Fed’s 2% target and thus another good reason for Jayman to start cutting rates.

Chart 2: The alternative inflation basket shows inflation peaked at >15% YoY

We continue using a similar methodology as NBER to create an inflation index and cost of money index from the UMich consumer survey to gauge the survey respondents’ purchasing decisions.

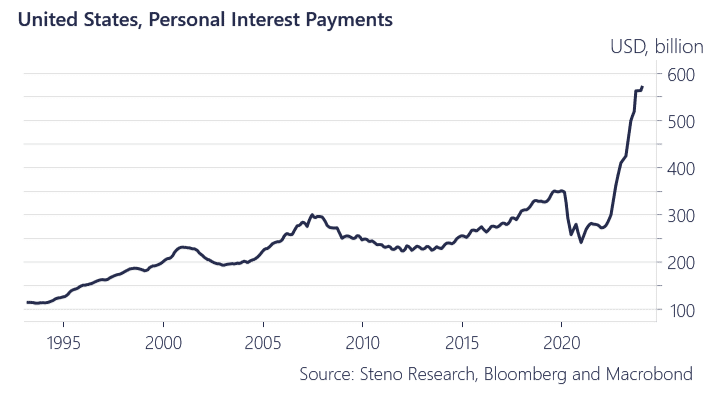

We currently see that inflation and the cost of money weighs equally on consumers. Looking at Chart 3.b we would argue that the increase in personal interest payments has helped spur higher price expectations since the decrease in discretionary income contributes to people demanding higher wages.

Could this be a contributing factor behind the lack of a slowdown in the US economy despite a material rate hiking cycle? We see a re-acceleration in inflation despite the hiking cycle. For our tradeable USD inflation view, read more here.

Chart 3.a: Cost of Money and Inflation perceived equally

Chart 3.b: Personal interest payments contributing to worries about prices

1 Comment

Nice concept this Out of the box -thing. It’s good (and cost effective) to have gone through an idea or thought process so when something similar ends up happening, you are ready with tradeable ideas.