Out of the box #8: The circle of life (and inflation)

In our “out of the box” series, we aim at being ahead of the current consensus narrative and think of the next theme that could drive price action before anyone else has given it any noteworthy attention.

Some would claim that this piece on inflation is classic inside-the-box thinking, but as we end up discussing the exact same things in every inflation cycle, I’ll try and lay out how I find the inflation cycle to develop from here.

The inflation numbers from the UK this morning is a perfect example of the current inflation debate. Core inflation keeps accelerating, but this is perfectly in line with what one should expect from the inflation cycle as core inflation is the biggest laggard in the cycle.

The disinflation narrative is alive and kicking (also in the UK), but we remain at a relatively early stage of it in Europe.

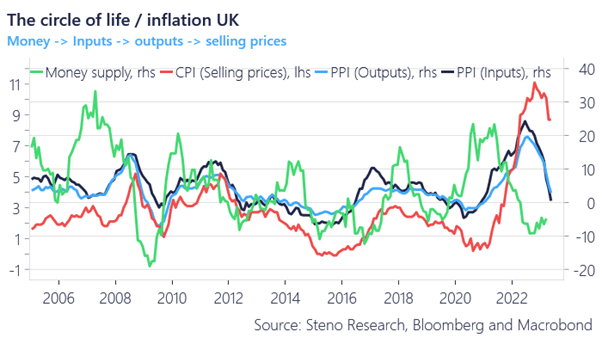

Chart 1: The circle of life..

Everything starts and ends with the money/credit creation. The yuge spike in credit creation through the early innings of the pandemic led to the spike in prices, while the destruction in the broad money supply will now slowly but surely prove to be the show-stopper for inflationistas at C-level and investment management functions.

The circle of life of inflation works both up and down in practice as well. The UK example below.

Learn how we look at inflation in Europe, the US and the UK with a 14 day trial below.

Chart 2: The circle of life in practice

We discuss the line of events in every single inflation cycle, so allow us to introduce the circle of life (and inflation). It is likely that we are at the juncture of falling output prices, which depending on margins will lead to lower consumer prices.

0 Comments