Out of the Box #26: OPEC is dead in it current form

Key take aways:

- OPEC losing its impact on the market due to non-OPEC members production

- For how long can Saudi Arabia pull all the weight?

- Europe and China would be the biggest winner in a OPEC breakdown

Hi and welcome to this year’s first ‘Out of the Box’. Readers of our energy coverage will know that we have been very skeptical of the developments around OPEC and the crude oil markets. We have therefore decided to put pen to paper on why we think OPEC is dead in its current form and what the implications of this are.

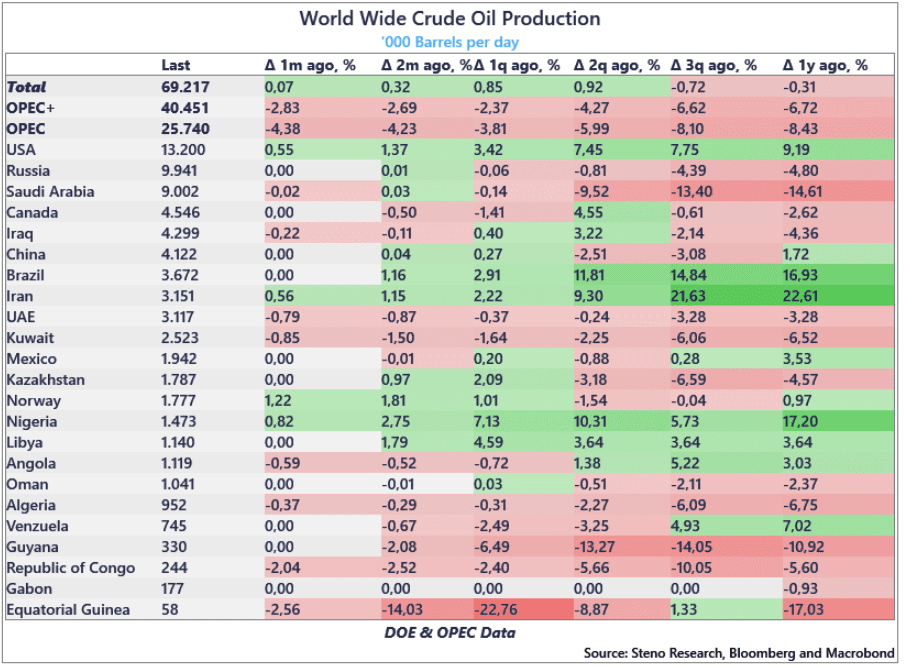

Ever since OPEC, spearheaded by the Saudis, initiated their first production cuts in the spring of last year an interesting dynamic has evolved in which OPEC pulls the load in terms of keeping the crude oil market up while simultaneously giving other countries such as the US and Brazil a huge freebie. It’s a quasi-transfer union in the crude oil market with OPEC subsidizing non-OPEC members.

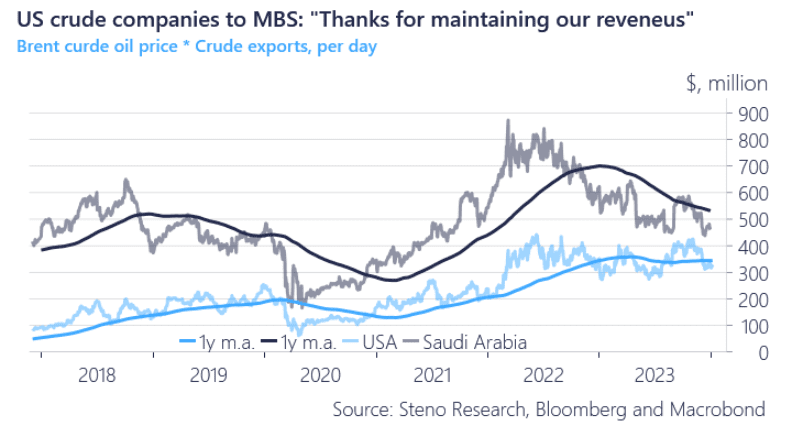

We see this transfer union illustrated well in chart 1.b where the US has been able to maintain its revenue throughout 2023 while the Saudis are down around USD 200 million per day in crude revenues. Note also that the likes of the US, Canada and Brazil have been ramping up over the past year which has made OPEC gradually lose its efficiency as a price setter and cartelist.

Chart 1.a: Brazil and the US among the big winners in terms of production output

Chart 1.b: The Saudi cut allowing the US to maintain its revenue

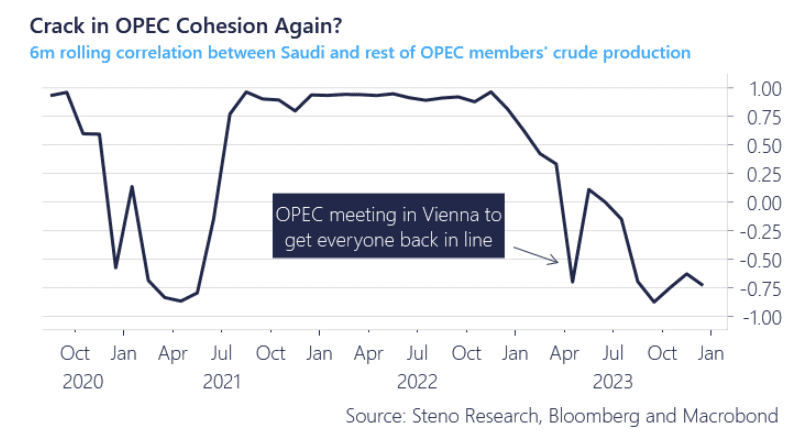

The dynamic of OPEC having to pull all the load to maintain the price of crude oil globally has in turn created internal frictions within OPEC. Looking at the 6 month rolling correlation between the Saudis and the rest of OPEC we find that there is a lack of cohesion within OPEC in terms of who is expanding and who is cutting. Back in May of last year (Chart 2) OPEC met in Vienna to get everybody back in line in terms of production quotas but the correlation shows that by the fall it was again all on the Saudis’ shoulders to lift the crude oil price.

For some members, the pressure of cutting became too much which is why Angola left OPEC late last year and it is straightforward to envision a scenario where countries either leave or cheat on their quota.

Chart 2: Emergency meeting in Vienna soon again?

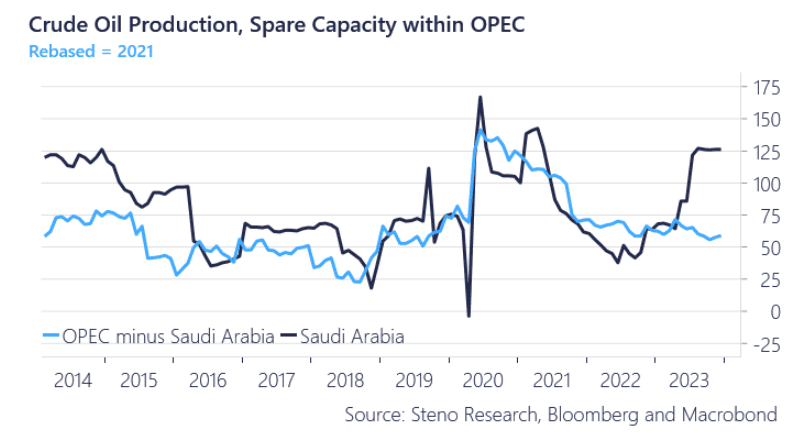

In terms of spare capacity it is noticeable how the Saudis have been almost the sole contributor in keeping barrels off the market and exactly herein lays the main issue for OPEC. If the Saudis decided that enough is enough and MBS wanted to get the pumps running again then shit would truly hit the fan within OPEC given in particular Russia and Iran’s dependency on crude revenues, which is likely also why both countries have been rather laissez-faire on their cuts.

Chart 3: Large spare capacity waiting to be released by the Saudis

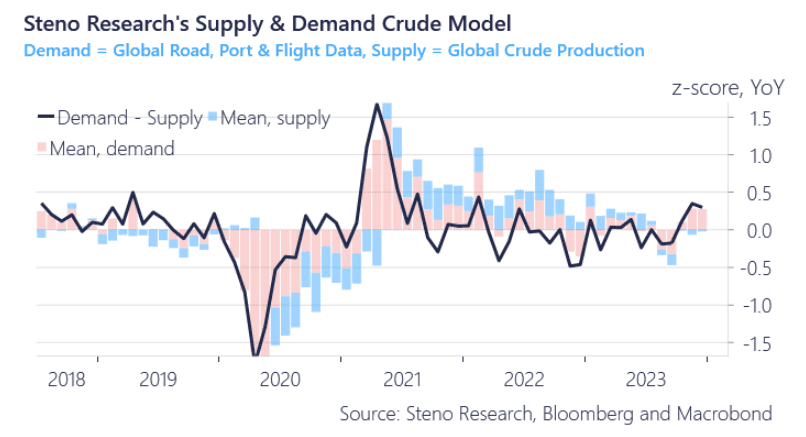

And there is indeed a lot for the Saudis to be irritated about in terms of OPEC members’ level of cohesion within the cartel. The paper market shorts, which were one of the initial reasons for production cuts, have started taking OPEC cuts less and less seriously thus cuts have gotten diminishing returns. The Saudis will also be wondering how crude oil is almost flat from the levels when the cutting cycle began, given that demand and (official) supply numbers point to bullish price action year-on-year.

OPEC states that demand remains robust which our model agrees with, but it raises the question of the validity of the supply data, especially from the likes of Russia and Iran. If the Saudis get too annoyed and tired of trying to keep the crude price up while losing tons of money then we could easily envision a scenario where they’ll let the oil flow. That would in turn most likely mean the death of OPEC given that prices would skyfall and the likes of Iran and Russia would lose big time in this scenario.

Chart 4: Uptick in global traffic, air and port data YoY

For financial markets, an OPEC breakdown would mean deflationary ways all over the globe but it would also have geopolitical implications. For 50 years, OPEC has wielded a major geopolitical power and been an extremely powerful power projection tool for the Arab world, especially Saudi Arabia. But a price cartel can’t function if it doesn’t control most of the market supply, so in some ways, it’s natural that OPEC is in decline with the emergence of the US and Canada as major oil-producing countries over the past 1-2 decades.

The breakdown of OPEC would initially be a huge win for the US geopolitically since it would open the field for freer oil trade and/or bilateral production agreements with countries such as Iraq, Kuwait, UAE, Nigeria etc. However, freer trade and increased competition would obviously also hit US oil revenues and at least financially the true winners would be net oil importers such as Europe and perhaps China.

The losers would obviously be Saudi Arabia which have been the de facto leaders of OPEC for some decades, but also a country such as Russia, which could suffer dramatically from increased competition which they are very ill-equipped to counter.

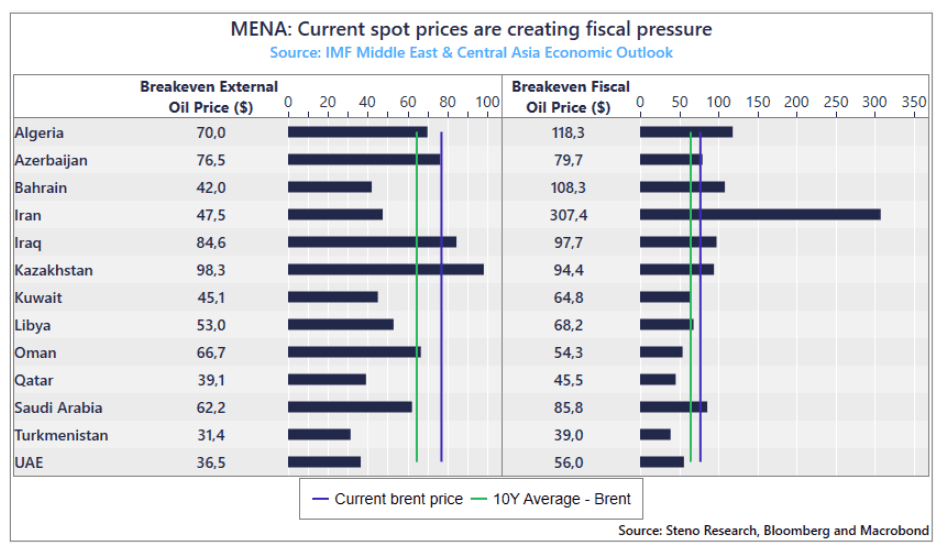

Chart 5: MENA breakeven vs Spot price

A complete dissolution of the OPEC cartel would have detrimental effects on all member countries, as the pursuit of revenue optimization by each producer would necessitate increased output and lower prices. While we consider it unlikely that the erosion of OPEC would lead to a cutthroat oil market, we do anticipate the emergence of significant political challenges. These challenges may be exacerbated by the divergence of interests among the major players within the cartel, all while the ongoing rivalry between the United States (and to a lesser extent, the Eurozone) and China remains in the background.

The growing likelihood of such a disintegration can perhaps be observed in the mounting tensions in the Middle East. Notably, there’s a growing divide between Iran, which welcomes higher prices but refuses to support production cuts due to its existing financial strain, and Saudi Arabia, which requires sustained higher prices to manage its substantial public investments and debt servicing.

In a year marked by China’s economic struggles, the United States facing another divisive Presidential Election, and escalating geopolitical tensions in the Middle East, will 2024 be the year when OPEC leaders acknowledge that the cartel is increasingly resembling a student dormitory rather than a disciplined cooperative monopoly?

The Death of OPEC is not on anybody’s radar for now but inherent contradictions in the existing ineffective setup is nonetheless hard to overlook.

2 Comments

Hi Ulrik, what does Breakeven fiscal?

Hi Jorge! It is graphing the current and 10-year average Brent prices against the “fiscal breakeven” price needed for various countries to start posting budget surpluses as well as the “external breakeven” oil price at which a nation’s current-account balance is zero, i.e. It covers its import bill.