Out of the Box #20: Gas and Steepeners brought to you by Muftis and Tsars

Nuclear energy is not sustainable in the long run.” – Angela Merkel

They say that god created economists to make the meteorologists look good, which we basically concur with, but it probably hasn’t ever been of a bigger relevance to combine weather- and economic forecasting than just now.

Conclusions up front:

– The risk/reward in going long Natural Gas is getting better by the week currently

– The European and Japanese trade surplus/deficit is 100% under the control of energy prices, leaving JPY and EUR vulnerable to such a spike in Nat Gas prices

– We are once again in the hands of Tsars and Muftis this Winter and we better hope that the wind blows..

Let’s look at the details

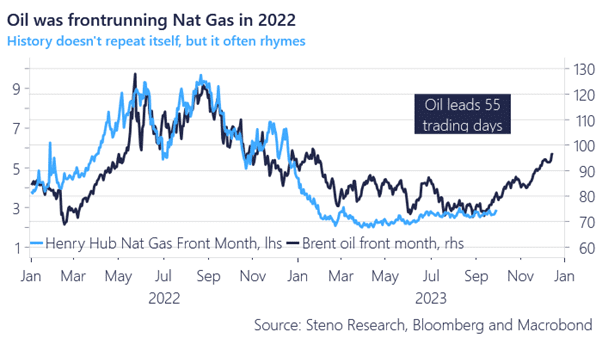

Natural gas storages do look absolutely OK in Europe, but we are still only one early cold spell away from a new bizarre price action in European gas markets. Last year, the oil market proved to be a bellwether of subsequent moves in the Natural Gas space, as the use of natural gas is highly seasonal even in comparison to other energy commodities.

We think the stars are aligning for a similar bullish setup in Natural Gas space this winter, but likely with a more moderate outcome space. We are once again in the hands of Tsars and Muftis and we better hope that the wind blows in Europe again this autumn.

If we add the for a potential restocking cycle in Germany to the mix, then we have a pretty perfect storm in Nat Gas markets brewing again. The risk/reward of going long is getting very tempting.

Chart 1: A strong bull-case for Nat Gas through Q4 again?

The reliance on Muftis and Zars in the energy policy reminds us of the 1970s and 1980s. Steepeners, higher Natural Gas Prices and tighter fiscal policy will likely be the end game in that order.

0 Comments