Out of the box #1: The “mystery” of the growing US deficit and why it is likely going to lead to lower interest rates

Welcome to the first edition of our new “Out of the Box” series where Emil Moller and I will think outside of the box on relevant macroeconomic topics and assess the implications for financial markets. Today, we will gauge whether the Inflation Reduction Act risks running wild due to its open-ended nature and whether we are all going to be surprised by the ramifications for the US budget and the debt ceiling.

Is the Inflation Reduction Act running wild?

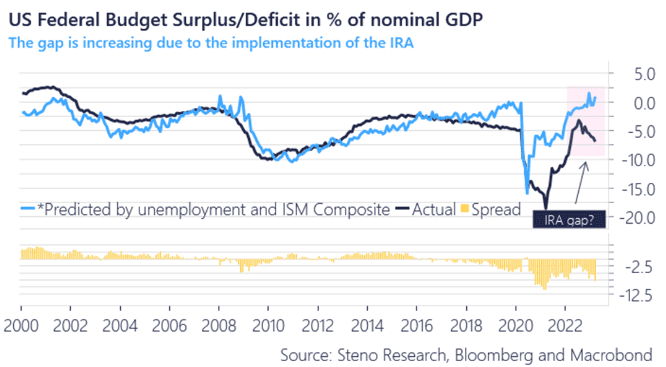

The Congressional Budget Office scored the Inflation Reduction Act with $308bn of deficit reduction over 10 years after $391bn of spending on projects related to the green transitioning over the implementation period (2022-2031). The question is whether the budget deficit has already been allowed to run wild because of the IRA, in sharp contrast to its medium-term intentions? Let’s have a look at the evidence at this juncture.

If we run a model of the unemployment rate and the ISM composite growth gauge against the Federal Budget deficit/surplus since 2000, we get a gap of almost 7% of GDP currently, which is the biggest gap ever outside of the pandemic, where the Federal Budget was let loose to prevent economic damage through the lockdowns.

Chart 1: The budget deficit is completely out of sync with the economic cycle. Biden is overspending

The US budget deficit is a whooping 7.5% of GDP worse than what it should be given the healthy employment and growth numbers of the economy. Is the Inflation Reduction Act running wild or what’s going on?

0 Comments