Oil Watch: Why is demand RECORD high, when we are told the opposite?

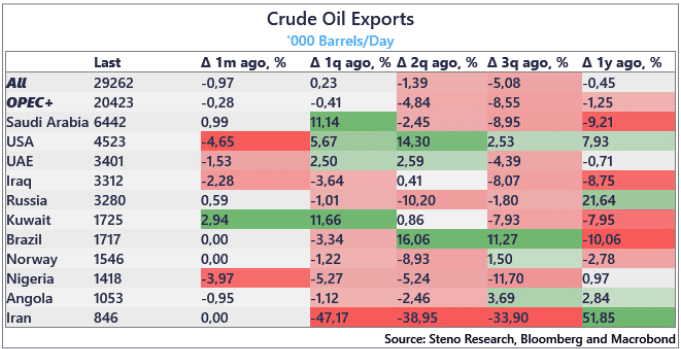

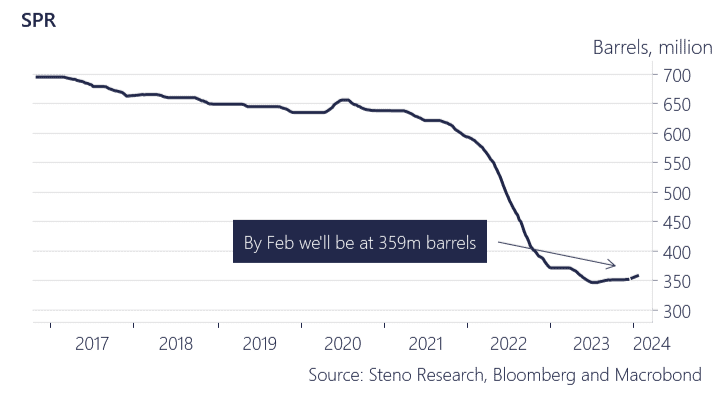

We start with crude oil exports where the latest m/m numbers reveal that the US has seen a 4.65% drop in export numbers in line with seasonal effects. The fewer seaborne barrels paired with tensions in the Red Sea have added to the momentum for oil prices, but we also note that the EIA has started to ramp up SPR buying again with contracts signed for the purchase of 3 million barrels.

The EIA will add an additional 4 million barrels from oil companies returning oil loaned to them through swaps which takes us to 359 million barrels at the SPR by the beginning of the new year. Still a long way away from the pre-energy crisis though.

When we don our tin-foil hats, we find it interesting that the EIA (wrongly) suggested that the oil demand was falling apart in September/October ahead of the re-introduction of SPR purchases. The EIA data was a major component behind the flipping of paper-market positions from longs to shorts, and we called the bluff and now get confirmed by the EIA on a weekly basis with extremely strong implied demand numbers from the US energy economy.

Chart 1.a: Sharp drop in US exports

Chart 1.b: And the EIA ramping up SPR buying

Our demand-based models on oil are through the roof and the demand has been exceptionally strong from a seasonal perspective in December. Is the narrative of a weak energy demand wrong?

0 Comments