Norway Watch: Cheat sheet to assessing Norges Banks rate path

Ahead of the Norges Bank meeting tomorrow morning, we’ll elaborate on the mechanics behind the rate path model at Norges Bank and how the new path will likely look tomorrow.

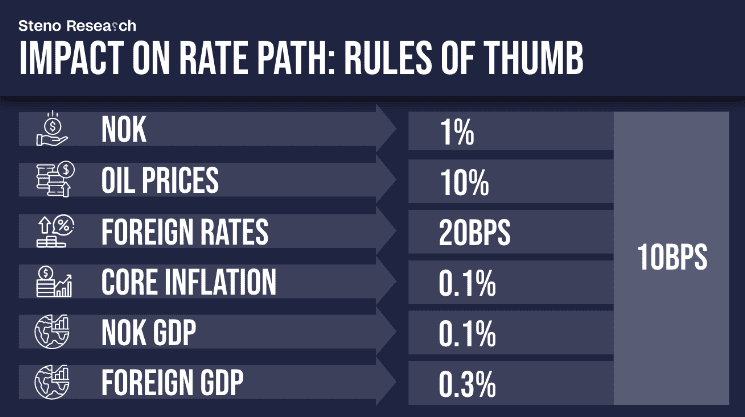

The below visualization is a great rule of thumb on the impact of various categories in the mechanical adjustment to the rate path.

If I44 (NOK import weighted) increases by 1% relative to the base-case, it impacts the curve by 10bps. If oil prices increase 10% relative to the base-case, it increases the yield curve by 10 bps via the oil investment channel, while core inflation (CPI-ATE relative to forecast) and foreign rates (I44-weighted forward curves) matter as well.

The NOK GDP is most timely measured by the current output survey in the regional network, while foreign GDP is I44 weighted again.

Chart 1: A cheat sheet to Norges Banks rate path

The mechanical adjustments are likely going to lead to a hawkish revision of the Norges Bank rate path tomorrow unless the subjective layer is used to send another signal. Risks tilted towards a hawkish take-away.

0 Comments