Japan Watch: How will Ueda cope with all of the “pauses”?

Here is why Ueda cannot save the JPY right now

This week, we are going to ask the question; “How will BoJ Governor Ueda cope with all of the “pauses” globally?” given that more and more central banks seem to be moving towards that conclusion, while Ueda didn’t even really get going with his normalization plans before all other central banks around him caving in.

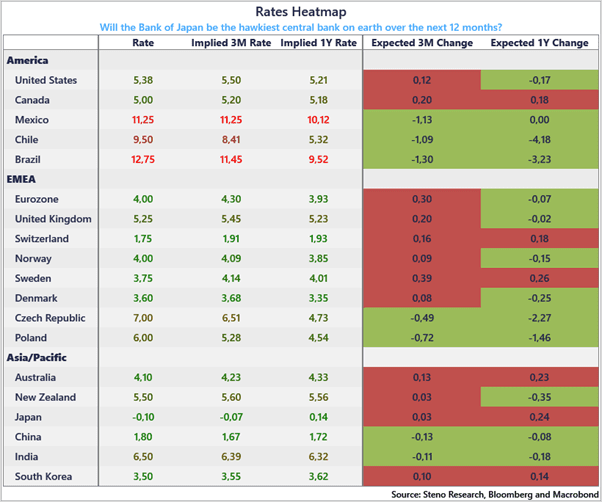

The BoJ is now priced to be the most hawkish CB on earth (among major CBs at least) over the next 12 months, with an embedded pricing of +24 bps.

It is not like markets expect a string of rate hikes from Ueda and the BoJ, but they at least expect them to try and move the needle in a hawkish direction while (almost) all other big CBs are priced to cut interest rates again over the same 12 months.

Feasible? I don’t think so honestly. Here is how we view the Japanese case relative to other G10 and Asian cases ahead of the BoJ meeting tomorrow.

Chart 1: The BoJ is priced to be the most hawkish major central bank in the world over the next 12 months

Ueda has got the situation under control and managed to orchestrate a whole string of positive market developments on the back of his monetary policy mix. There are no major reasons to change course. Steepen the JPY curve slowly, while accommodating the short-end.

0 Comments