Inventory Nugget – How are world inventories in metals and grains looking?

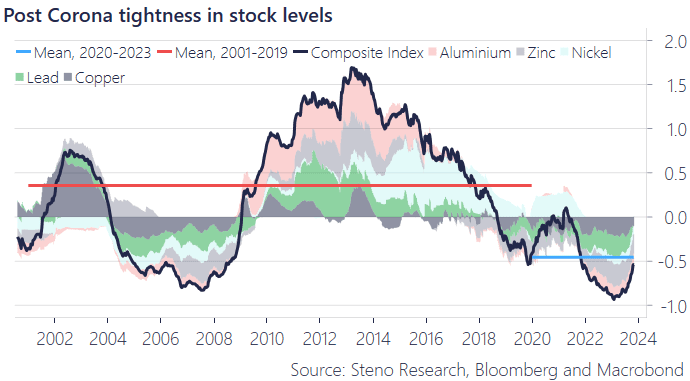

Happy Tuesday, and welcome to another one of our short nuggets, where it’s all about the charts and short conclusions! Today we will briefly dig into the world of commodity inventories, which despite tightness doesn’t seem to matter unless demand surprises positively to the upside. Something tells us that’s exactly what’s gonna happen.

We will mainly focus on industrial metals and grains, whereas energy inventories will be covered in our weekly Energy Cable / EIA Watch.

Industrial Metals

- Although supply has been tight in industrial metals globally, sluggish demand has ruined the bull-party for most of 2023, but inventories are now starting to fill again. An early demand sign, or is it just China taking advantage of the temporary offer in commodity prices? Chinese import numbers from today (3% YoY vs -5% expected) could be the latter, as Xi has probably acknowledged that higher commodity stocks are desirable in order to manufacture a rebound.

- If storages/demand will get a tick upward, it will have to come from the emerging world, where the biggest importers of industrial metals are (China/India in particular)

- Industrial metals have had a rough year as the supply-demand cocktail has been skewed to the bearish side, and based on current commodity price-action, it seems like markets have a hard time making up their minds on how the picture will look going forward

- Interestingly enough, copper inventories are increasing in almost all major economies, which could be a sign that the manufacturing rebound is still going strong.

Chart 1: Tight supply, but maybe not for long?

The supply side has probably been what’s driven commodities higher in 2023, but how is the supply looking in metals and grains currently given the recent surprising momentum in for example Iron Ore?

0 Comments