G3 Rates Watch: No one’s got a clue on R*, yet the market is convinced that it does!

What a week in Fixed Income space! The bloodbath after the hot US CPI report partially continued today, but equities have a tremendous ability to recover fast after inflation/rate shocks these months as the anticipated lean from central banks remains dovish.

In this short G3 rates watch, we take a practical stance on the R* concept. If an economy can re-accelerate given current rate levels, it seems likely that R* is even higher than thought by many economists including the entire ilk of PhDs at the Federal Reserve.

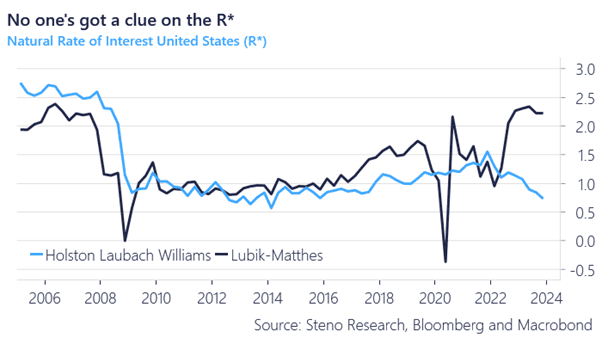

The two most used academic approaches to R* have moved in exact opposite directions since 2022, which goes to show that no one has a clue. Yet the market seems very hellbent in leaning dovish in forward pricing despite an evident ongoing re-acceleration of the cyclical components of the economy.

What does that mean for rates markets in the months ahead?

Chart 1: No one’s got a clue on the equilibrium rate level

High for longer vibes are once again impacting the EUR- and USD rates forward pricing. Is the market wrong to assume that equilibrium rates have to be lower than current spot levels? None of us knows, yet the market is hellbent on assuming it knows!

0 Comments