G3 Central Bank Watch: More fuel to the 2007 = 2023 analogy

We have used the 2007 = 2023 analogy a few times already this year and we continue to find coincidental evidence that looks a lot like the emerging pressures built up in the quarters preceding the financial crisis.

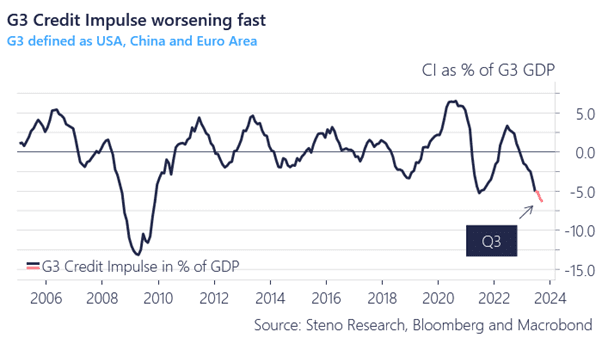

The outcome of 2024 is still up in the air, but credit indicators do not look pretty ahead of next year when we combine the impulse in China, the US and the Euro area in an aggregate model and judging from the central bank behavior, we see a lot of similarities to 2007 across the BoJ, the Fed and the ECB.

Is this another recipe for disaster? Read more below…

Chart 1: The credit impulse ahead of 2024 looks recessionary

We are in many ways experiencing 2007 all over. The BoJ is considering a move on the policy rate, the ECB is in a hawkish denial, while the Fed is undeniably still the most sensible “pauser” of the three.

0 Comments