FX Watch: Have FX markets sniffed out an upcoming rebound?

Welcome to the second research piece in our “Business Cycle Week”. In this edition of the series on the business cycle, we will focus on whether FX markets sniff out the cycle ahead of other asset markets. Is the USD a bellwether of global trends or is it just a saying?

Let’s look at the evidence of what FX markets may tell us about the business cycle.

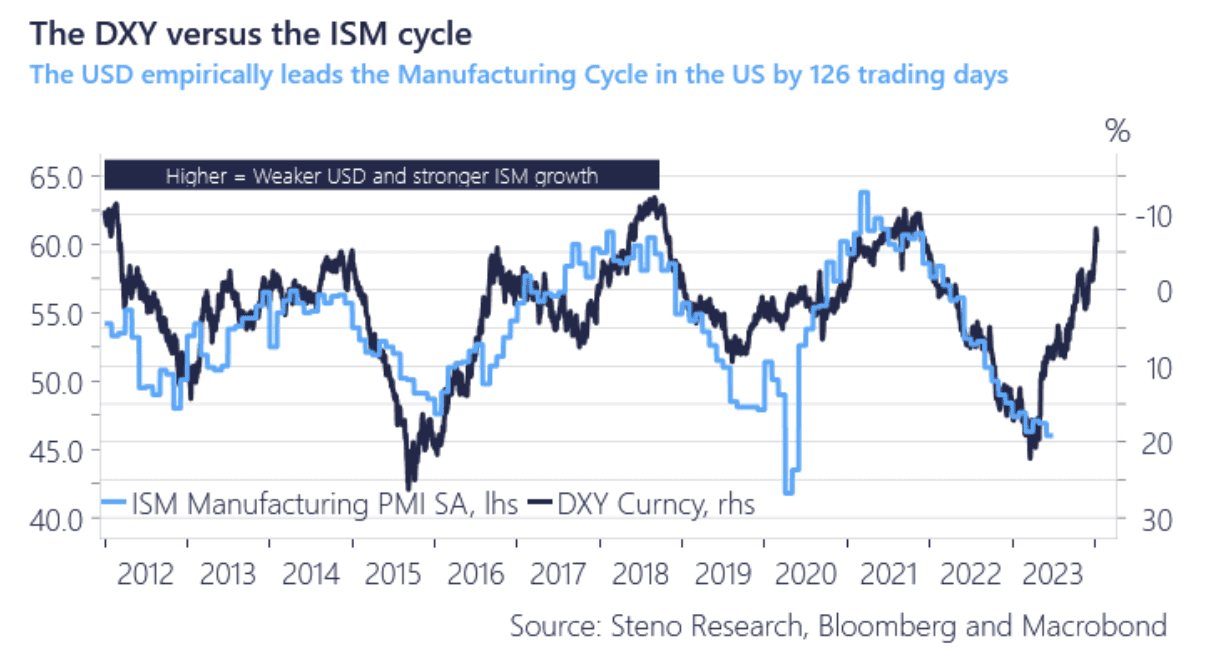

“The USD is a bellwether of global cyclical growth trends”. This is a saying I have heard a lot through my career on trading floors but is it really true? Looking at the DXY and its ability to predict turning points in the US economy since 2008, I have to admit that there is a bit of merit to the view that the USD indeed is a bellwether for economic trends.

A weakening USD typically softens financial conditions in the rest of the world, which leads to a synchronized upswing due to softer credit conditions measured in USD for foreigners.

The pattern has been strong since 2000 (R^2 improves until the 126th lag), but there are a few outliers during recessions with 2008 and 2020 as the best examples. The current USD selling has a “cyclical rebound” tattooed all over it according to historical patterns (see chart 1)

Chart 1: The USD leads the cyclical growth by 126 trading days

USD weakness paired with an uptrend in cyclical currencies sounds like the perfect rebound cocktail, but can FX markets rightfully reveal turning points in the economic cycle? Let’s have a look at the current pricing and the historical evidence.

0 Comments