FX Nugget: What policy normalization? The BoJ is as interventionist as ever….

Markets are stuck in a discussion on the JPY this morning as BoJ governor Ueda and PM Kishida held a meeting allegedly discussing FX developments. Our models continue to signal weakness ahead for the JPY.

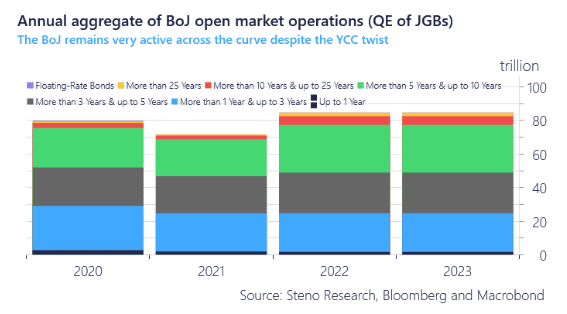

Even a move to 1% in the YCC-curve control has NOT allowed the BoJ to become less interventionist. On current trends, 2023 will lead to a new record high in nominal purchases of JGBs.

Pair that with tapering/balance sheet reductions among peers and you have a weakening/debasement cocktail in store for the JPY still.

Chart 1: The Bank of Japan will likely reach a new record for nominal buying of JGBs in 2023

Ueda and Kishida met earlier today, allegedly to discuss currency developments among other things. Despite efforts to move away from the ultra-easy monetary policy, the BoJ remains as active as EVER..

0 Comments