Fed Nugget: Why the Fed dot plot will remain hawkish

It is time for the FOMC meeting this afternoon/evening depending on your location and we see a high probability of the FOMC solidifying that another hike is coming in November or December, which is not the base case for markets currently (accumulative 11bps priced in for the rest of the year by the time of writing).

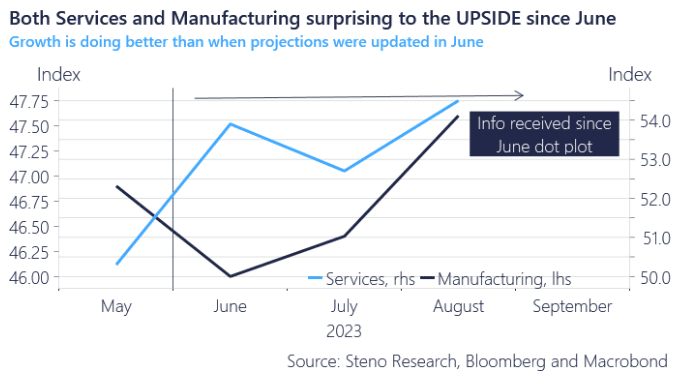

Let’s have a look at three simple chart studies on the developments in 1) Growth, 2) Inflation, and 3) Labour since the June dot plot that will be updated later.

1) Growth

Both Services and Manufacturing have clearly surprised the UPSIDE since the June meeting and all sell-side economists have been busy revising up growth forecasts. The Fed will do the same.

Chart 1: Big upside surprise in Services + Manufacturing through Q3

Given the information received since the last update of the dot plot in June, inflation has surprised to the upside, the growth gauges have surprised to the upside, while the labor market has surprised to the downside. Net/net no reason to alter the dot plot.

0 Comments